Buying a house in the United States involves more than just the listed price of the home. Understanding the full cost is essential whether you’re a first-time buyer or investing in property.

This guide breaks down the average costs and factors that influence how much you’ll pay when buying a house in the USA.

1. Average Home Price in the U.S.

As of recent data, the median home price in the U.S. is around $420,000, though this varies widely depending on location:

- High-cost states like California, New York, and Washington: $600,000+

- More affordable markets like Texas, Ohio, or North Carolina: $300,000–$400,000

2. Down Payment

Most buyers pay a down payment between 5% and 20% of the home’s purchase price:

- On a $400,000 home, that’s $20,000 to $80,000

- First-time buyers may qualify for lower down payments through FHA loans (as low as 3.5%)

3. Closing Costs

Closing costs typically range from 2% to 5% of the loan amount:

- For a $400,000 home, expect to pay $8,000 to $20,000

- These include fees for appraisal, title insurance, attorney, taxes, and lender charges

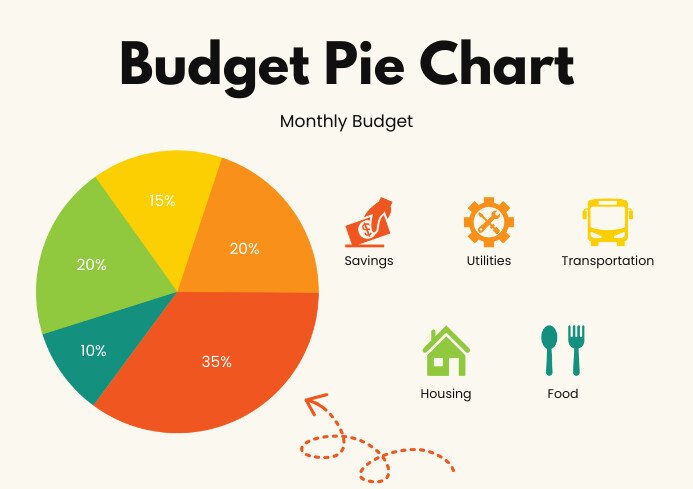

4. Monthly Mortgage Payments

Your monthly mortgage will depend on:

- Loan amount

- Interest rate

- Property taxes

- Homeowners insurance

- HOA fees (if applicable)

On average, a 30-year fixed mortgage on a $400,000 home with a 20% down payment and 6% interest would result in a monthly payment of around $1,920.

5. Additional Costs to Consider

- Property taxes: Vary by state—typically 0.5% to 2.5% of home value annually

- Homeowners insurance: Around $100–$200/month, depending on location

- Maintenance and repairs: Budget 1% of home value per year

- HOA fees: Can range from $100 to $1,000+/month

Frequently Asked Questions (FAQ)

Q: What is the average cost of buying a house in the U.S.?

A: The median home price is about $420,000, plus $20,000–$80,000 for down payment and $8,000–$20,000 in closing costs.

Q: How much do I need to buy a house with no money down?

A: Some programs like VA loans (for veterans) and USDA loans allow zero-down options, but eligibility is limited.

Q: Is it cheaper to rent or buy a house in the U.S.?

A: It depends on location and market conditions, but historically, buying can be more cost-effective over the long term.

Join The Discussion