If you’re planning to buy a home or refinance your current mortgage, you’re probably wondering: Will house mortgage rates drop in 2025?

Mortgage rates have remained elevated since 2023 due to inflation and Federal Reserve policies — but there’s growing speculation that they may start to trend downward this year. In this post, we’ll explore what experts are saying, what could cause mortgage rates to fall, and what it means for you.

Current Mortgage Rate Trends (2025)

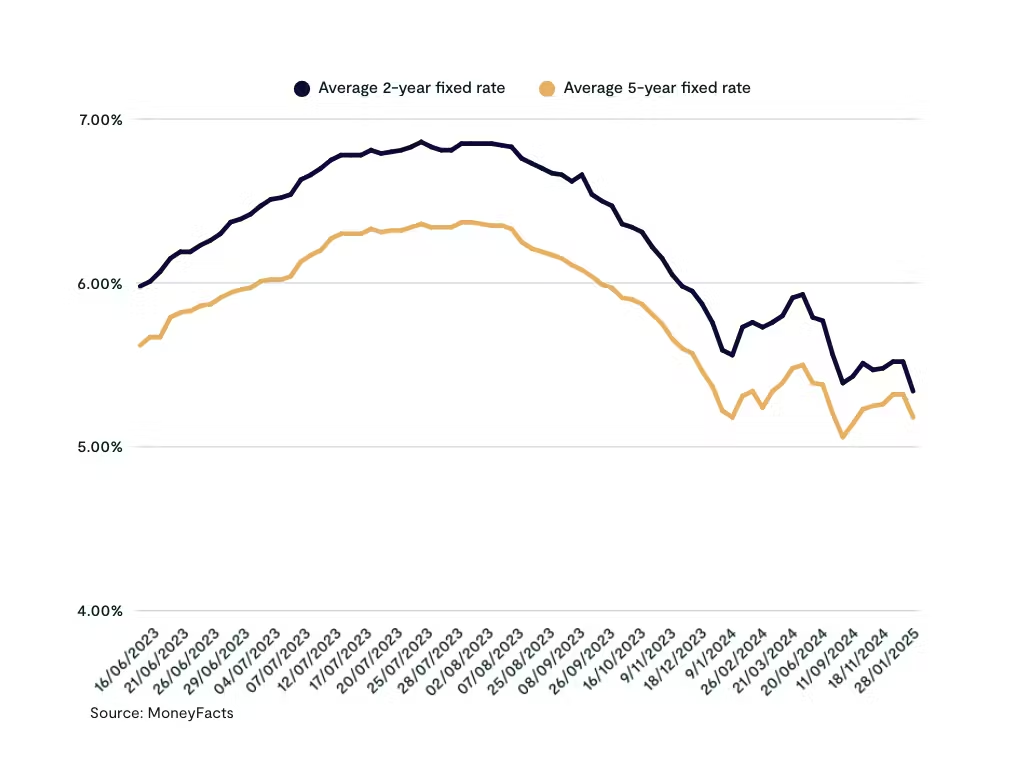

As of early 2025 , the average 30-year fixed mortgage rate is hovering around 6.3% – 6.5% , down slightly from late 2024.

Here’s a quick look at recent trends:

| 2023 | ~6.4% |

| 2024 | ~6.7% |

| 2025 (Early) | ~6.4% |

While not dramatically lower, many analysts believe rates could continue to decline gradually , especially in the second half of the year.

What Could Cause Mortgage Rates to Drop?

Several key economic factors influence mortgage rates. Here are the main ones that could lead to a decline:

1. Slowing Inflation

If inflation continues to cool, lenders may feel more confident lowering interest rates.

2. Federal Reserve Interest Rate Cuts

The Fed doesn’t set mortgage rates directly, but its benchmark rate affects borrowing costs. If the Fed starts cutting rates in 2025, mortgage rates may follow.

3. Economic Slowdown or Recession Fears

In times of economic uncertainty, investors often move money into bonds — pushing bond yields (and mortgage rates) down.

4. Improved Housing Market Balance

If home supply increases and demand stabilizes, pressure on prices and financing could ease.

Expert Predictions for Mortgage Rates in 2025

Most major housing and financial institutions are cautiously optimistic:

| Freddie Mac | 6.1% by Q4 2025 |

| Fannie Mae | 6.0% average for 2025 |

| National Association of Realtors (NAR) | Gradual decline to below 6% |

| Mortgage Bankers Association | Slight decrease, with volatility continuing |

While no one can predict the future with certainty, most forecasts suggest a modest drop — assuming inflation remains under control and the economy avoids a sharp downturn.

What This Means for Homebuyers and Refinancers

If mortgage rates do fall in 2025:

- Homebuyers may see improved affordability.

- Current homeowners could benefit from refinancing opportunities.

- First-time buyers might find more homes available as the market adjusts.

However, don’t wait too long — even small drops can make a big difference over the life of a loan.

Final Thoughts

Yes, house mortgage rates are expected to drop in 2025 , though likely only gradually and moderately . If you’re planning to buy or refinance, now is a good time to monitor trends, improve your credit score, and get pre-approved so you’re ready when rates become more favorable.

Stay informed, be patient, and consult with a trusted lender to make the best decision for your situation.

Frequently Asked Questions (FAQs)

Q1: Will mortgage rates go below 5% in 2025?

Most forecasts expect rates to stay between 5.8% and 6.5% , depending on economic conditions — with a possible dip below 6% later in the year.

Q2: When is the best time to lock in a mortgage rate in 2025?

Consider locking in when you find a home and are approved for a loan — especially if rates are trending downward.

Q3: How will falling mortgage rates affect home prices?

Lower rates could increase buyer demand, which may help stabilize or support home price growth in many markets.

Join The Discussion