If you have bad credit , you might be wondering: Can I still get a house mortgage? The good news is — yes, it’s possible .

While a low credit score can make the homebuying process more challenging, there are mortgage options designed specifically for borrowers with less-than-perfect credit . In this post, we’ll walk you through how to qualify for a mortgage with bad credit and explore your best options.

What Is Considered “Bad Credit” for a Mortgage?

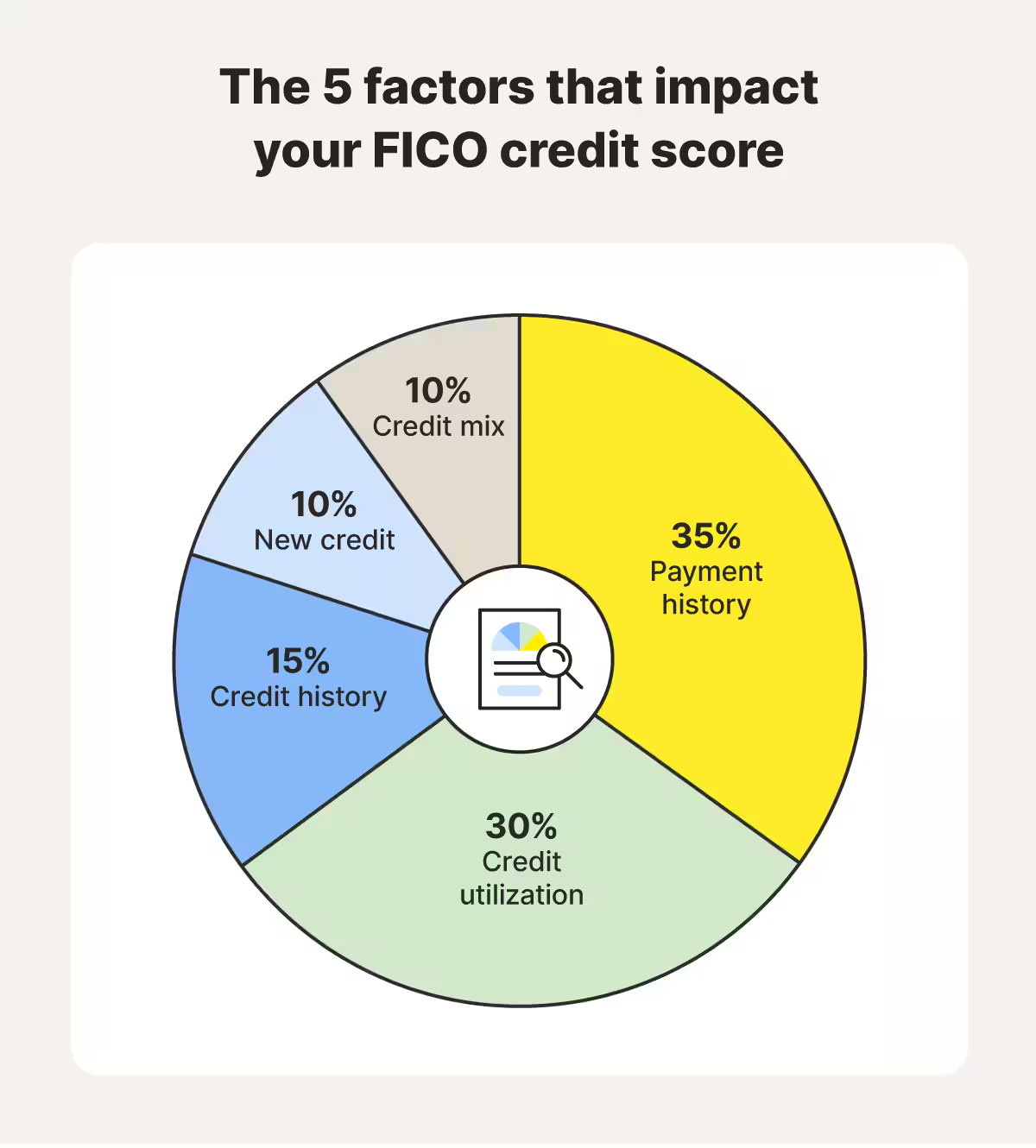

Most lenders use the FICO credit scoring model , which ranges from 300 to 850:

| 720–850 | Excellent |

| 690–719 | Good |

| 630–689 | Fair |

| Below 630 | Poor/Bad |

A score below 620 is typically considered subprime , but some lenders still offer loans — just at higher interest rates.

Mortgage Options for Bad Credit

Here are the most common types of mortgages that work well for buyers with lower credit scores:

✅ 1. FHA Loans

- Minimum credit score : 580 for 3.5% down

- Down payment : As low as 3.5%

- Backed by the Federal Housing Administration

- Most popular option for buyers with poor credit

✅ 2. VA Loans (For Veterans)

- No minimum credit score set by the VA

- Often accepted with scores as low as 500–550

- No down payment required in many cases

✅ 3. USDA Loans

- Designed for rural and suburban homebuyers

- Minimum credit score around 580–620

- Zero-down payment option if income-eligible

✅ 4. Conventional Loans with Non-Prime Lenders

- Available to borrowers with scores as low as 500–600

- Higher down payments (often 10–20%) and interest rates apply

How to Improve Your Chances of Approval

Even with bad credit, there are steps you can take to strengthen your mortgage application:

🔹 Check Your Credit Report

Dispute any errors that may be dragging down your score.

🔹 Pay Down Debt

Lower your debt-to-income ratio (DTI) to increase your odds of approval.

🔹 Save for a Larger Down Payment

A bigger down payment reduces risk for lenders and may help offset a low credit score.

🔹 Get a Co-Borrower

Adding a spouse or family member with better credit can improve your chances.

🔹 Work With an Experienced Lender

Find a lender who specializes in low-credit or subprime mortgages .

Sample Mortgage Rates Based on Credit Score

| 670+ | ~6.0% | ~$1,498 |

| 620–669 | ~6.5% | ~$1,580 |

| 580–619 | ~7.2% | ~$1,700 |

| Below 580 | ~8.0%+ | ~$1,850+ |

💡 These are rough estimates — actual rates will vary based on location, loan type, and lender.

Final Thoughts

Yes, you can get a house mortgage with bad credit — especially with government-backed loans like FHA, VA, or USDA . While you may pay a higher interest rate, buying a home with a low credit score is still very much within reach if you prepare properly and work with the right lender.

The key is to understand your options, improve your financial standing where possible, and seek out programs designed for borrowers like you.

Frequently Asked Questions (FAQs)

Q1: Can I get a mortgage with a 500 credit score?

Yes, especially with FHA or specialized subprime lenders — though expect higher rates and larger down payment requirements.

Q2: What is the lowest credit score to buy a house?

FHA loans allow scores as low as 500–579 , depending on down payment and lender guidelines.

Q3: How can I buy a house with bad credit fast?

Focus on improving your DTI, saving for a down payment, and working with a lender experienced in low-credit mortgages.

Join The Discussion