What Does “Mortgage Is House Loan” Mean?

When someone says, “mortgage is house loan,” they’re simply stating that:

🔑 A mortgage is a type of loan used specifically to buy a house.

It’s not just any personal loan — a mortgage is secured by the property itself , meaning if you stop making payments, the lender can take back the home through foreclosure .

So yes — a mortgage is a house loan. And it’s the most common way people finance home purchases.

How Does a Mortgage Work?

Here’s a basic breakdown of how a mortgage functions:

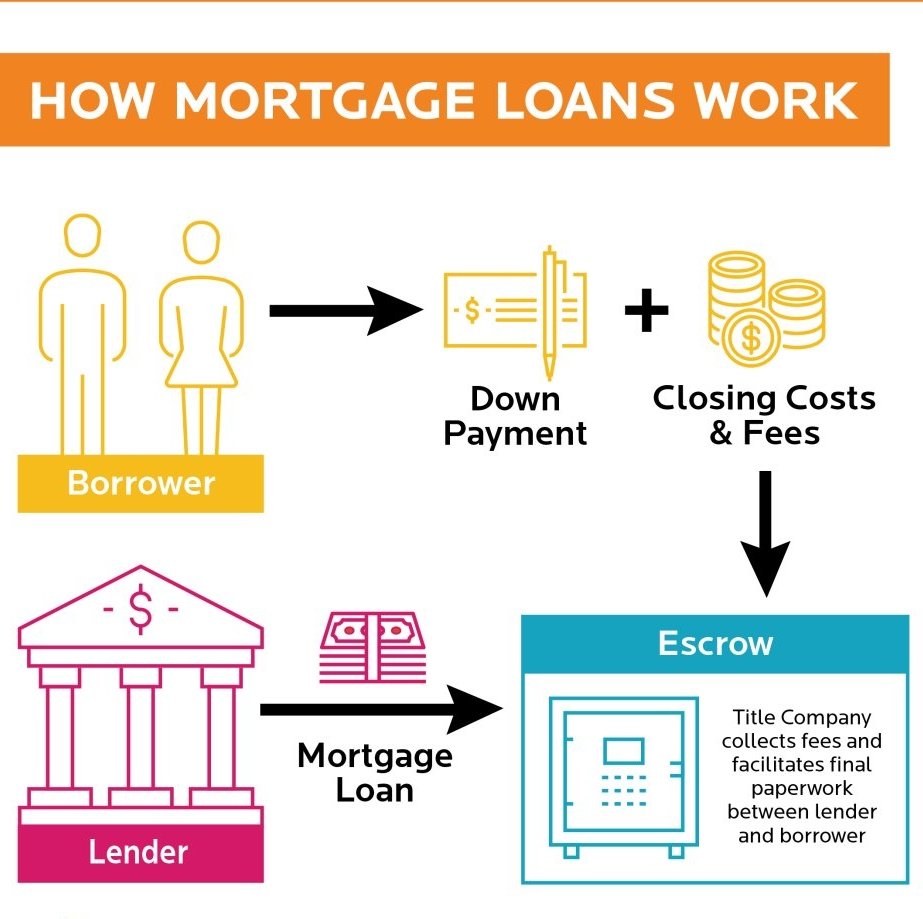

- You apply for a loan from a bank, credit union, or mortgage company.

- You make a down payment — usually between 3% and 20% of the home’s price.

- The lender covers the rest with a mortgage loan.

- You repay the loan over time — typically 15 to 30 years — with interest.

- Once the loan is paid off , you own the home free and clear.

Key Parts of a Mortgage Payment

Your monthly mortgage payment usually includes:

| Principal | The amount you borrowed to buy the home. |

| Interest | The cost of borrowing money from the lender. |

| Property Taxes | Paid to your local government based on your home’s value. |

| Homeowners Insurance | Protects against damage and is required by lenders. |

This combination is often referred to as PITI :

P rincipal + I nterest + T axes + I nsurance.

Types of Mortgages (House Loans)

There are several types of mortgages to choose from, depending on your financial situation and goals:

| Fixed-Rate Mortgage | Interest rate stays the same for the entire loan term. Most popular for long-term stability. |

| Adjustable-Rate Mortgage (ARM) | Rate changes after an initial fixed period (e.g., 5/1 ARM). Often offers lower initial rates. |

| FHA Loan | Backed by the Federal Housing Administration. Designed for buyers with lower credit scores or smaller down payments. |

| VA Loan | Available to veterans and active-duty military members. Often requires no down payment. |

| USDA Loan | For buyers in rural areas. Offers zero-down options for qualified applicants. |

Why Mortgages Are So Important

Buying a home is one of the biggest financial decisions you’ll ever make. Since most people can’t afford to pay hundreds of thousands of dollars upfront, mortgages make homeownership possible .

Some key benefits:

- Spread the cost over decades

- Build equity over time

- Deduct mortgage interest from taxes (in many cases)

- Lock in stable housing costs with a fixed-rate loan

Final Thoughts

Yes, a mortgage is a house loan — and it’s the foundation of homeownership for millions of people. Whether you’re buying your first home or upgrading to something bigger, understanding how mortgages work helps you make smarter financial decisions.

From choosing the right loan to managing your monthly payments, knowing the basics puts you in control of your home-buying journey.

Frequently Asked Questions (FAQs)

Q1: Is a mortgage the same as a house loan?

Yes, a mortgage is a type of secured house loan used specifically for purchasing real estate.

Q2: Do I own the house with a mortgage?

Yes, you legally own the home, but the lender holds a lien until the loan is fully paid.

Q3: Can I sell my house if I still have a mortgage?

Yes, most homes are sold while still under a mortgage. The loan is paid off using the proceeds from the sale.

Join The Discussion