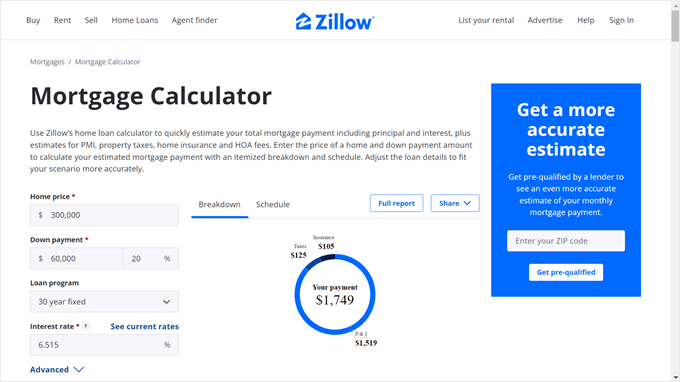

When buying a home, understanding your monthly mortgage payment is essential. The Zillow Home Loans Calculator is a powerful online tool that helps homebuyers estimate their monthly payments, understand how different loan terms affect affordability, and compare financing options.

Here’s a complete guide on how to use the Zillow mortgage calculator effectively.

1. What Is the Zillow Home Loans Calculator?

The Zillow Home Loans Calculator is a free, user-friendly tool available on Zillow.com that allows you to:

- Estimate monthly mortgage payments

- Explore different loan types (30-year, 15-year, FHA, VA)

- Adjust inputs like down payment, interest rate, and property taxes

- See how much house you can afford

It’s ideal for first-time buyers, refinancers, or anyone planning a real estate purchase.

2. How to Use the Zillow Mortgage Calculator

Using the Zillow Home Loans Calculator is simple:

Step-by-Step:

- Enter the home price: Type in the listing price of the home you’re considering.

- Input your down payment: Choose a percentage or dollar amount (e.g., 3.5%, 20%).

- Select your loan type: Choose from conventional, FHA, VA, USDA, or adjustable-rate mortgages.

- Adjust the interest rate: You can use the default rate or input your own based on current market data.

- Include taxes and insurance: Enter estimated property taxes, homeowners insurance, and HOA fees if applicable.

- Review your results: See your estimated monthly payment breakdown.

3. Key Features of the Zillow Mortgage Calculator

- Loan comparison tool: Compare different loan terms side by side.

- Affordability estimator: Shows how much house you can afford based on income and debt.

- Amortization schedule: View how much of each payment goes toward principal vs. interest over time.

- Mobile-friendly: Accessible via desktop or mobile devices for on-the-go planning.

4. Why Use the Zillow Home Loans Calculator?

- Free and easy to use

- Helps set realistic expectations before applying for a loan

- Saves time by filtering homes within your budget

- Provides clarity on how down payment, taxes, and rates impact your monthly costs

Conclusion

The Zillow Home Loans Calculator is a valuable tool for any prospective homebuyer. By giving you clear insights into your potential mortgage payments, it empowers you to make informed decisions and shop for homes within your budget.

Frequently Asked Questions (FAQ)

Q: Is the Zillow mortgage calculator accurate?

A: Yes, it uses standard mortgage formulas and average tax/insurance estimates, but actual payments may vary slightly due to lender-specific fees.

Q: Can I use the Zillow calculator to compare loan types?

A: Yes, Zillow allows you to compare multiple loan scenarios side by side, including 15-year vs. 30-year loans.

Q: Does Zillow offer a refinance calculator?

A: Yes, Zillow has a separate refinance calculator to help homeowners determine if refinancing makes financial sense.

Join The Discussion