Introduction

The California real estate market in 2024 was marked by stabilization after years of volatility. With mortgage rates leveling off and buyer demand returning, the year offered both opportunities and challenges for homebuyers and investors alike.

In this review, we’ll cover:

- Key market trends from 2024

- Price movements and affordability

- Top-performing cities

- What to expect moving into 2025

Let’s take a closer look at how California’s housing market evolved in 2024.

California Housing Market Overview (2024)

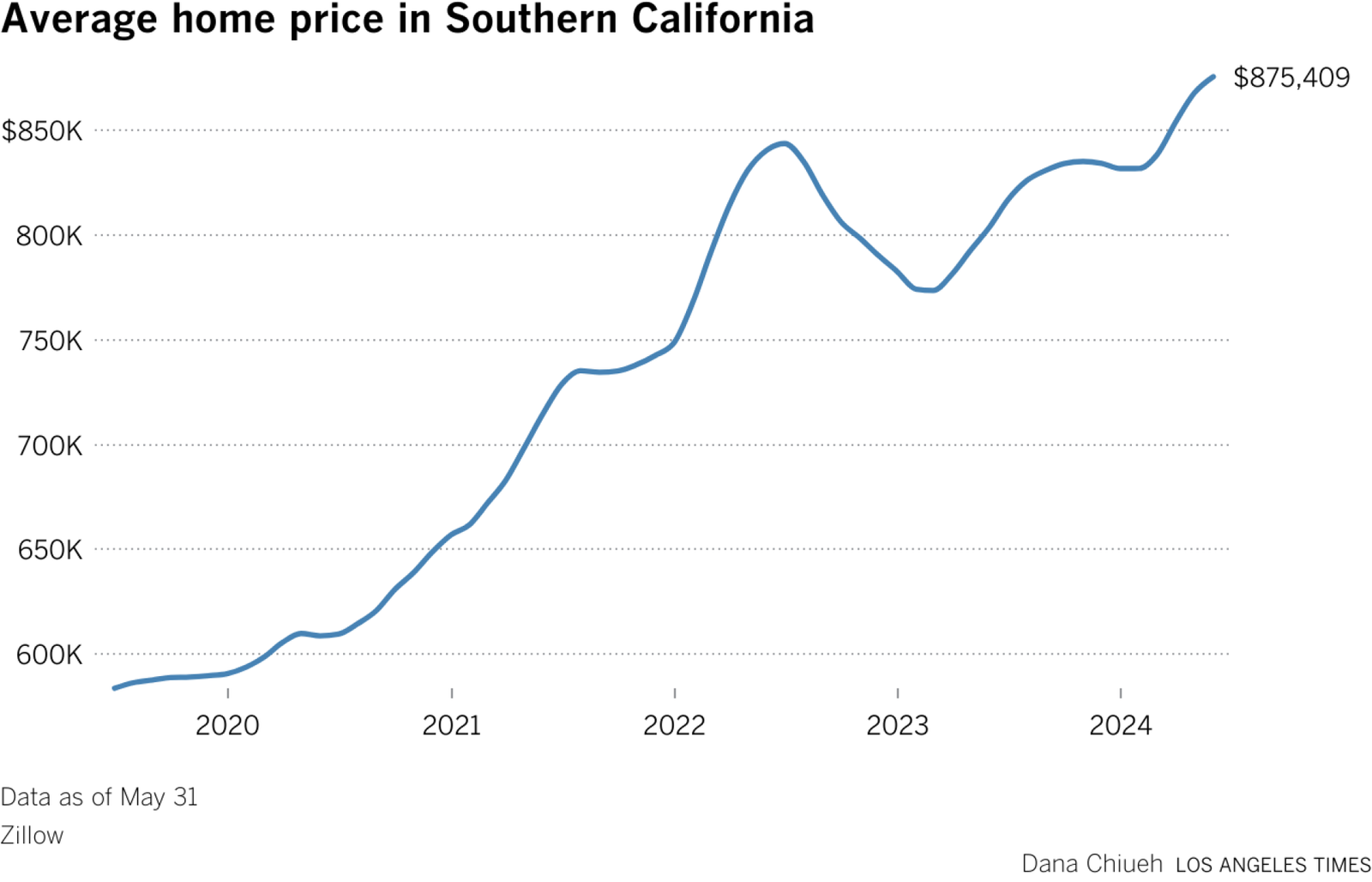

After a slowdown in 2023, the 2024 housing market showed signs of balance between supply, demand, and pricing.

Key Highlights:

- Median Home Price : $775,000 (modest increase from 2023)

- Inventory : Improved slightly with 2.1 months of supply

- Mortgage Rates : Stabilized around 6.5%

- Sales Volume : Rose by ~4% YoY as buyers re-entered the market

- Rental Growth : Picked up to +2.8%, driven by high home prices

Despite ongoing affordability issues, 2024 proved to be a transitional year—setting the stage for stronger activity in 2025.

Top Performing Cities in 2024

Certain markets stood out due to strong buyer interest, rental demand, and value growth.

| Sacramento | $560,000 | $2,400/month | State capital remained a top investment spot |

| Fresno | $410,000 | $1,900/month | High returns and growing population |

| Bakersfield | $390,000 | $1,800/month | Attractive for first-time buyers |

| Inland Empire (Riverside/San Bernardino) | $430,000 | $2,200/month | Logistics boom supported investor demand |

| San Jose | $1,400,000 | $3,500/month | Tech-driven market remained resilient |

Price and Inventory Trends (2024 Recap)

- Early 2024 : Prices rose slowly due to low inventory

- Mid-Year : More listings hit the market, easing pressure

- Late 2024 : Appreciation picked up in select areas

Overall, home values increased modestly but held strong in desirable locations.

Major Influences on the 2024 Market

Several economic and policy factors shaped the year:

| Stable Mortgage Rates | Helped buyers plan long-term |

| New Construction Growth | Slight increase in housing supply |

| Remote Work Continuation | Buyers moved further from urban cores |

| Rent Control Expansion | Affected investor returns in some cities |

| Wildfire Insurance Reforms | Improved availability in fire-prone zones |

These changes influenced where people bought, how much they paid, and how investors positioned themselves.

Lessons for Buyers and Investors

For Buyers:

- Timing is key : Mid-year offered more selection and stable prices.

- Look beyond coastal cities : Inland markets offer better value.

- Get pre-approved early : Competitive offers still matter.

For Investors:

- Rental markets remain strong : Demand continues despite higher financing costs.

- Wholesaling and fix-and-flips rebounded : Better deals available mid-year.

- Focus on cash flow : Rising property values don’t always equal profit.

Outlook for 2025

Experts predict continued appreciation across most California markets, especially in affordable regions. Remote work trends, infrastructure investments, and limited land supply will likely support demand in 2025.

Smart buyers and investors who focus on value-driven markets like Sacramento, Bakersfield, and Fresno should find strong opportunities ahead.

Join The Discussion