If you’re thinking about buying a home or refinancing your current mortgage, one of the biggest questions on your mind is likely: Are house mortgage rates going down? In 2025, many buyers and homeowners are watching interest rate trends closely after a period of steady increases. Let’s take a closer look at what’s influencing mortgage rates and what experts are predicting for the rest of the year.

What Affects Mortgage Rates?

Mortgage rates are influenced by several factors including:

- Federal Reserve Policy : Although the Fed doesn’t set mortgage rates directly, its decisions on short-term interest rates can impact long-term rates like those for mortgages.

- Inflation Trends : High inflation typically leads to higher rates. As inflation cools, lenders may lower mortgage rates.

- Economic Growth : Strong job markets and consumer spending can push rates up, while signs of slowing growth may bring them down.

- Bond Market Activity : Mortgage rates often follow the yield on the 10-year Treasury note.

Current Mortgage Rate Trends (2025)

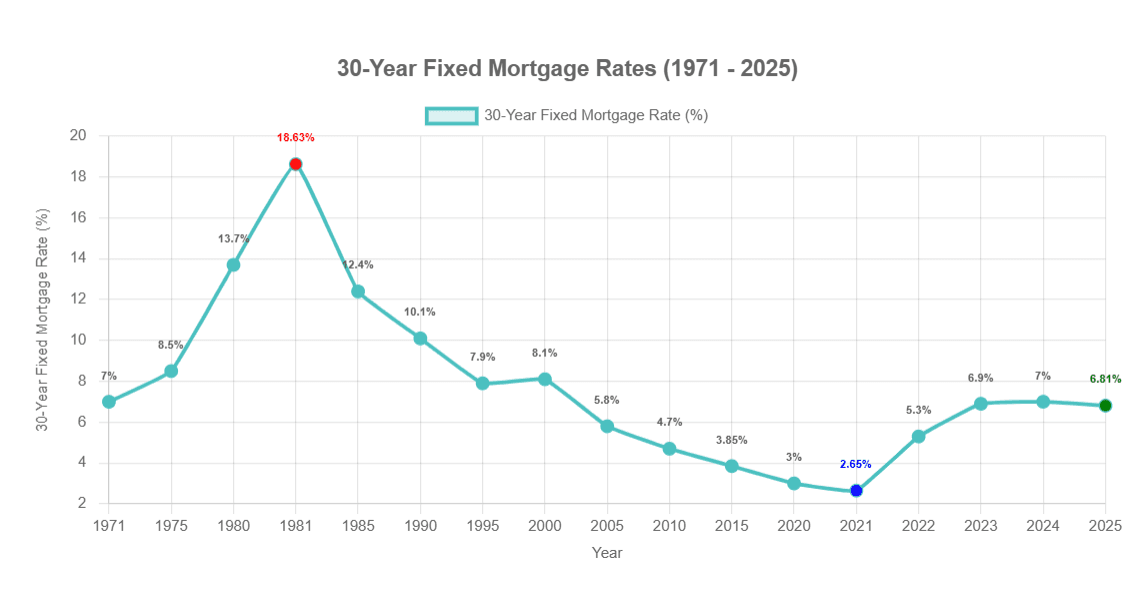

As of early 2025, mortgage rates have shown some signs of stabilization after peaking in late 2023 and early 2024. The average 30-year fixed mortgage rate hovered around 6.5% at the start of the year, but there are indications that rates could gradually decline if inflation continues to ease and the Federal Reserve begins cutting benchmark interest rates.

Expert Predictions

Most financial analysts and housing market experts believe that mortgage rates will trend downward in the second half of 2025 , assuming the economy avoids major shocks and inflation remains under control. Some forecasts suggest rates could dip below 6% by the end of the year.

Organizations like Freddie Mac, Fannie Mae, and the National Association of Realtors (NAR) are cautiously optimistic about rate reductions, especially if the Fed decides to cut the federal funds rate later this year.

What This Means for Homebuyers

If mortgage rates do fall, it could mean:

- Lower monthly payments for new buyers

- Increased buying power

- More opportunities to refinance existing mortgages

However, even with slightly lower rates, affordability may still be a challenge due to rising home prices in many markets.

Conclusion

While no one can predict the future with certainty, the signs in early 2025 point toward mortgage rates potentially going down as the year progresses. If you’re considering buying a home or refinancing, now might be a good time to start preparing—monitor rate trends, improve your credit score, and consult with a trusted lender.

Stay tuned for updates, and don’t forget to shop around when it’s time to lock in your rate!

Join The Discussion