If you’re a homeowner or planning to buy a home, you might be wondering: are house taxes included in mortgage payments? The short answer is: sometimes yes, sometimes no . It depends on the type of loan you have and how your mortgage is structured.

In this post, we’ll explain how property taxes work with mortgages, what an escrow account is, and what you need to know to manage your payments effectively.

What Are Property Taxes?

Property taxes—often referred to as house taxes —are taxes paid to your local government based on the assessed value of your home. These funds typically go toward public services like schools, roads, emergency services, and infrastructure.

The amount varies widely depending on where you live. For example, homeowners in high-tax states like New Jersey or Illinois can pay thousands more annually than those in lower-tax states like Nevada or Hawaii.

Are Property Taxes Included in My Mortgage?

Yes, property taxes are often included in monthly mortgage payments—but only if you have an escrow account set up with your lender.

Here’s how it works:

- Lenders collect a portion of your estimated annual property tax each month along with your principal and interest.

- These funds are held in an escrow account and used to pay your property tax bill when it’s due.

- This helps spread the cost of a large annual or semi-annual tax bill into manageable monthly installments.

Common Mortgage Structures

| Conventional Loan (with escrow) | ✅ Yes | Most common for homeowners |

| FHA Loan | ✅ Yes | Escrow required by law |

| VA Loan | ✅ Yes (usually) | Escrow may be required depending on lender |

| Conventional Loan (no escrow) | ❌ No | Borrower pays taxes directly; less common |

| Mortgage Paid Off | ❌ No | Once the loan is paid, you handle taxes directly |

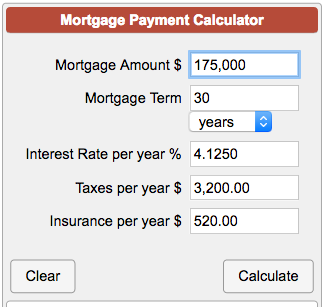

Example of a Mortgage Payment with Taxes

Let’s say your monthly principal and interest is $1,500 , and your annual property tax is $3,600 .

Your lender would add $300/month ($3,600 ÷ 12 months) to your payment, making your total monthly mortgage $1,800 , which includes taxes.

Pros and Cons of Including Taxes in Your Mortgage

✅ Pros:

- Predictable monthly payments

- Avoids risk of missing a tax deadline

- Helps budgeting by spreading costs over the year

❌ Cons:

- You don’t earn interest on the money held in escrow

- Some people prefer managing their own finances

- Escrow accounts can cause confusion during refinancing or moving

What Happens If You Don’t Have an Escrow Account?

If your mortgage doesn’t include property taxes, it’s your responsibility to pay them directly to your local government on time. Missing a payment can result in penalties, interest charges, or even a tax lien on your property.

How to Check If Your Mortgage Includes Property Taxes

You can check your monthly mortgage statement or contact your lender directly. Most statements break down your payment into:

- Principal

- Interest

- Property taxes

- Homeowners insurance

- (Sometimes) PMI or HOA fees

Conclusion

So, are house taxes included in mortgage payments? In most cases, especially with standard home loans, yes —as long as you have an escrow account. This system makes budgeting easier and ensures your taxes are paid on time.

However, if you prefer more control over your finances, you can opt out of an escrow account (if your lender allows it), but that means taking full responsibility for paying property taxes when they’re due.

Join The Discussion