Introduction

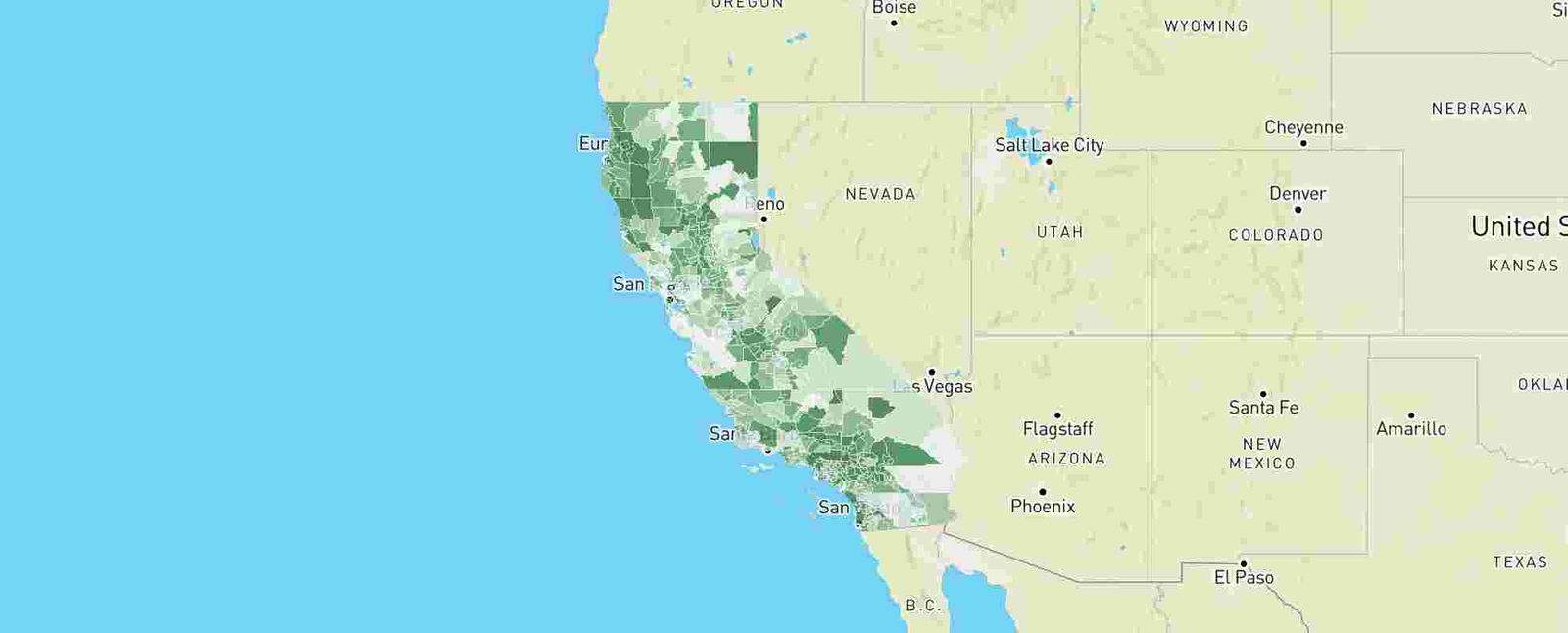

Understanding the average appreciation of real estate in California is essential for homebuyers, investors, and homeowners looking to build long-term wealth. California’s housing market has historically outperformed national averages due to its strong economy, limited land supply, and high demand.

In this guide, we’ll explore:

- Historical appreciation rates

- Current year-over-year (YoY) growth

- Top cities with the strongest appreciation

- Factors influencing future value

- What to expect in 2025 and beyond

Let’s dive into the numbers behind California home value growth.

What Is Real Estate Appreciation?

Real estate appreciation refers to the increase in property value over time. This can be influenced by:

- Economic conditions

- Job growth

- Interest rates

- Housing supply and demand

- Local infrastructure development

Appreciation plays a key role in long-term wealth building through equity growth.

California Real Estate Appreciation: Key Stats (2025)

As of early 2025, California’s housing market continues to show resilience despite rising interest rates and economic uncertainty.

Statewide Overview:

- Median Home Price : $780,000

- Average Annual Appreciation (Last 5 Years) : 6.1%

- Annual Appreciation (2024–2025) : 3.5%

- Historical 10-Year Appreciation Rate : 5.8%

- Rental Growth Rate : +3.2% YoY

How Does California Compare Nationally?

California’s appreciation rates have generally outpaced the U.S. average, especially in coastal areas.

| 5-Year Avg. Appreciation | 6.1% | 5.4% |

| 10-Year Avg. Appreciation | 5.8% | 5.1% |

| Median Home Price (2025) | $780,000 | $390,000 |

| YoY Appreciation (2024–2025) | 3.5% | 2.9% |

Top Cities with Highest Real Estate Appreciation in California (2025)

While statewide appreciation averages around 3.5%, some cities are seeing much stronger gains—especially those near job centers or with growing populations.

| San Jose | $1,400,000 | +4.7% |

| Oakland | $820,000 | +4.5% |

| Sacramento | $560,000 | +4.2% |

| Fresno | $410,000 | +4.0% |

| Bakersfield | $390,000 | +3.9% |

| Los Angeles | $960,000 | +3.6% |

| San Diego | $850,000 | +3.5% |

| San Francisco | $1,300,000 | +3.3% |

Factors Influencing Appreciation in California

Several factors drive home value increases across the state:

1. Economic Growth

Tech, healthcare, entertainment, and logistics industries fuel job creation and housing demand.

2. Population Growth

Migration from other states and international buyers support ongoing demand.

3. Limited Housing Supply

Especially in coastal and urban markets, low inventory keeps prices stable or rising.

4. Interest Rates

Mortgage rates have stabilized around 6.2%, improving affordability compared to recent volatility.

5. Remote Work Trends

More buyers are relocating to more affordable inland cities while maintaining income from major metro areas.

6. Infrastructure Investments

New transit systems, highways, and broadband expansion improve desirability and access.

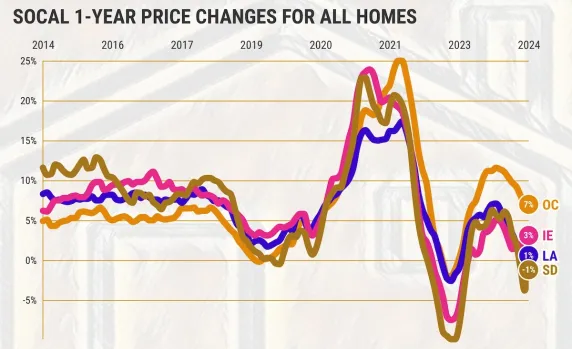

Regional Differences in Appreciation

Not all parts of California appreciate at the same rate. Here’s how different regions compare:

| Bay Area | 3.8% |

| Southern California | 3.6% |

| Central Valley | 4.1% |

| Inland Empire | 4.0% |

| Northern California (Outside Bay Area) | 3.5% |

| Sierra & Mountain Areas | 3.2% |

Investment Implications

For real estate investors, understanding appreciation trends helps identify high-growth opportunities.

Best Markets for Long-Term Value:

- Sacramento – Affordable entry point with strong rental demand

- Bakersfield – High cash-on-cash returns and growing population

- Fresno – Strong tenant retention and steady home value growth

- Inland Empire – Logistics boom supports appreciation and investment potential

Future Outlook for Real Estate Appreciation in California

Experts project continued, albeit moderate, appreciation over the next five years. As remote work stabilizes and infrastructure investments expand, inland and secondary markets are expected to gain momentum.

Sustainability-focused developments and green building practices are also expected to gain traction, offering long-term value to forward-thinking investors.

Forecasted Annual Appreciation (2025–2030):

- Coastal Markets : 3.0–4.0%

- Inland Markets : 4.0–5.0%

- Mountain/Lakefront Areas : 3.0–3.5%

Conclusion

The average appreciation of real estate in California remains strong, even amid economic shifts. While appreciation has slowed slightly from the rapid pace of the last decade, many markets continue to offer solid long-term value.

By understanding where appreciation is strongest and aligning your strategy with market trends, you can make informed decisions that maximize your return on investment—whether you’re buying a home, renting out property, or flipping houses.

Frequently Asked Questions (FAQs)

Q: What is the average appreciation rate for California homes?

A: Around 3.5% annually as of 2025, though some cities see up to 4.7% growth.

Q: Which California city has the highest appreciation?

A: San Jose , followed closely by Oakland and Sacramento.

Q: Will California home values keep rising?

A: Yes, especially in inland and secondary markets with strong job growth and lower entry costs.

Join The Discussion