Finding the best mortgage interest rates can save you tens of thousands of dollars over the life of your loan. Whether you’re buying a home or refinancing, understanding current rate trends and how to qualify for the lowest rates is essential.

Here’s a breakdown of the best mortgage interest rates available in the U.S., along with tips to help you secure the most competitive deal.

1. Current Average Mortgage Rates (2025)

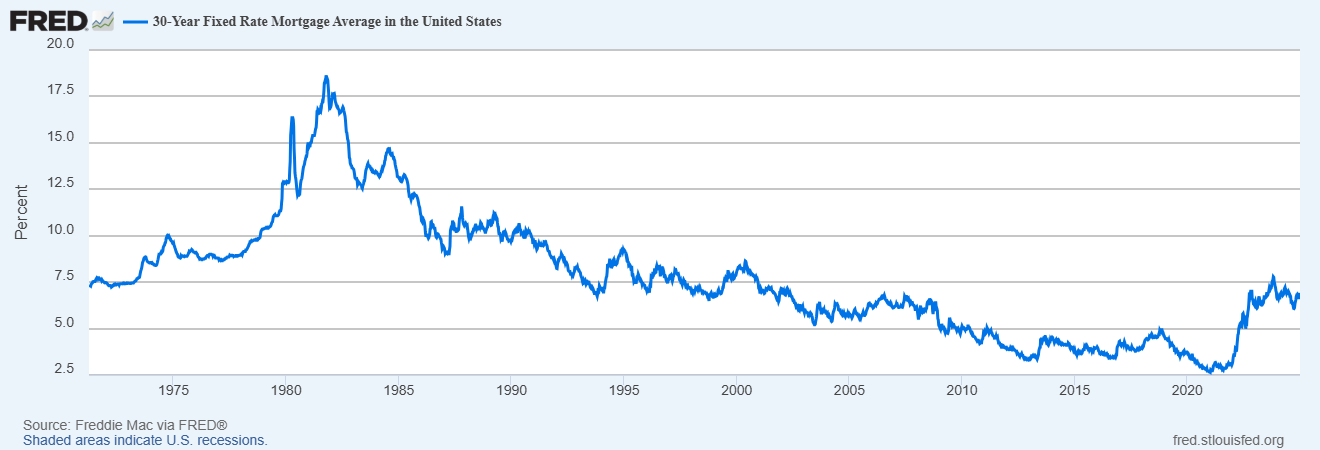

As of early 2025, average mortgage rates in the U.S. are:

- 30-Year Fixed: ~6.2%

- 15-Year Fixed: ~5.5%

- FHA Loan (30-Year): ~6.0%

- VA Loan (30-Year): ~5.9%

- Adjustable-Rate Mortgage (ARM): ~5.7%

These rates fluctuate daily based on economic conditions, so it’s important to lock in a rate when it aligns with your timeline.

2. Factors That Influence Your Rate

Lenders determine your mortgage rate based on several key factors:

- Credit Score: Higher scores typically result in lower rates (680+ preferred)

- Down Payment: Larger down payments reduce risk and often lead to better rates

- Loan Type: FHA, VA, USDA, and conventional loans have different rate structures

- Debt-to-Income Ratio (DTI): Lower DTIs signal financial stability

- Loan Term: Shorter terms (like 15 years) usually come with lower rates than 30-year loans

3. Top Lenders Offering Competitive Rates

Some of the top lenders known for offering low mortgage rates include:

- Quicken Loans (Rocket Mortgage) – Great for digital-first buyers

- Chase Bank – Strong customer service and in-person support

- Wells Fargo – Offers relationship discounts and educational tools

- Better.com – Transparent pricing and fast approvals

- Bank of America – Relationship-based rate reductions for existing customers

Always compare offers from multiple lenders to find the best deal.

4. Tips to Get the Best Mortgage Rate

- Check your credit report and fix any errors before applying

- Shop around and get quotes from at least 3–5 lenders

- Consider paying points to buy down your interest rate

- Lock in your rate once you’re satisfied with the offer

- Improve your DTI and savings before submitting an application

Conclusion

The best house mortgage interest rates depend on both the market and your personal financial profile. By improving your credit, shopping around, and working with top lenders, you can significantly reduce your long-term costs and make homeownership more affordable.

Frequently Asked Questions (FAQ)

Q: What is the lowest mortgage interest rate available?

A: Rates vary daily, but as of early 2025, the lowest rates are around 5.5% for 15-year fixed loans and 5.9% for VA loans.

Q: Can I negotiate my mortgage interest rate?

A: You can’t directly negotiate the rate, but you can shop around and ask lenders to match or beat competing offers.

Q: Are mortgage rates expected to go down in 2025?

A: Some analysts predict gradual declines later in 2025 if inflation continues to ease and the Federal Reserve lowers benchmark rates.

Join The Discussion