With many Americans watching the housing market closely, a common question is: Can house mortgage rates go up? The short answer is yes — and in certain economic conditions, they often do. In 2025, mortgage rates remain sensitive to inflation, Federal Reserve policies, and global economic trends. Let’s explore what could cause mortgage rates to rise and what it means for you.

What Causes Mortgage Rates to Go Up?

Mortgage interest rates don’t just move randomly — they’re influenced by several key factors:

1. Inflation

When inflation rises, lenders demand higher interest rates to compensate for the reduced purchasing power of future loan repayments.

2. Federal Reserve Policy

The Fed doesn’t directly set mortgage rates, but its decisions on the federal funds rate can influence long-term borrowing costs. If the Fed raises rates to fight inflation, mortgage rates often follow.

3. Bond Market Trends

Mortgage rates are closely tied to the yield on the 10-year U.S. Treasury note . When investors sell bonds due to uncertainty or inflation fears, yields — and mortgage rates — tend to climb.

4. Strong Economic Growth

A booming economy with low unemployment and rising wages can push rates upward as demand for credit increases.

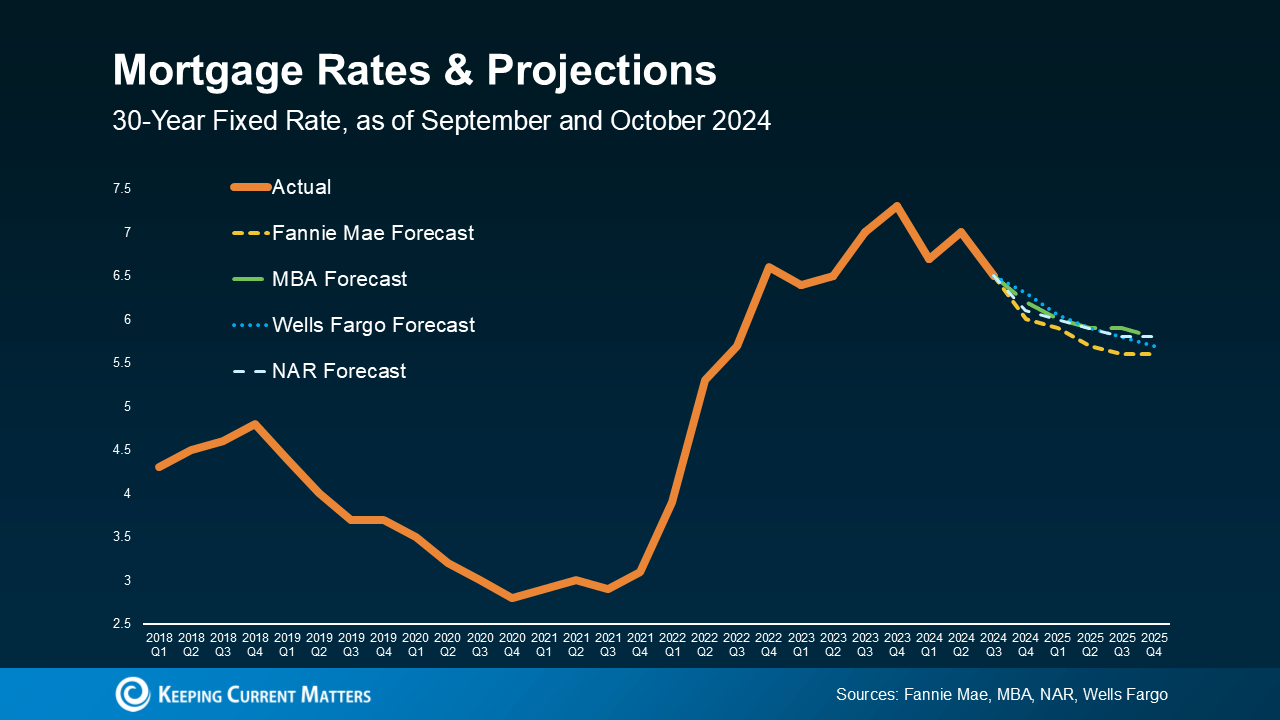

Are Mortgage Rates Going Up in 2025?

As of early 2025, mortgage rates have stabilized after climbing steadily through 2023 and 2024. While some experts predicted a gradual decline if inflation cooled, recent economic data suggests that rates may rise again temporarily , especially if:

- Inflation rebounds

- The labor market remains strong

- Geopolitical tensions increase

- The Fed delays rate cuts

How Rising Rates Affect Homeowners and Buyers

If mortgage rates go up, here’s what you can expect:

For Homebuyers:

- Higher monthly payments even for the same home price.

- Reduced buying power — you may qualify for a smaller loan.

- Fewer bidding wars as affordability becomes a challenge.

For Current Homeowners:

- Refinancing becomes less attractive unless you have a much higher existing rate.

- No immediate impact unless you have an adjustable-rate mortgage (ARM).

For Sellers:

- Slower sales due to fewer qualified buyers.

- Possible need to adjust listing prices to stay competitive.

Should You Be Worried?

While rising mortgage rates can be concerning, they’re part of a normal economic cycle. If you’re planning to buy or refinance, timing matters. Consider locking in your rate if you see favorable terms, and always work with a trusted lender who can guide you through rate fluctuations.

Final Thoughts

Yes, house mortgage rates can go up — and there’s a real chance they might rise again in 2025 depending on economic conditions. Stay informed, monitor rate trends, and be ready to act when the time is right for your financial goals.

Join The Discussion