One of the most common questions homeowners ask is: “Can you sell a house with a mortgage?” The answer is a clear yes — in fact, most homes are sold while still under a mortgage.

However, there are specific steps and considerations involved in selling a home that’s not yet paid off. In this post, we’ll walk you through everything you need to know about selling a mortgaged property.

How Selling a Mortgaged Home Works

When you sell a house with a mortgage:

- The proceeds from the sale go toward paying off your existing mortgage.

- Any remaining money after paying the lender is yours to keep (or use toward your next home).

- If the sale price is less than what you owe , you may need to cover the difference — unless you qualify for a short sale .

This is the standard process whether you’re upgrading, downsizing, or relocating.

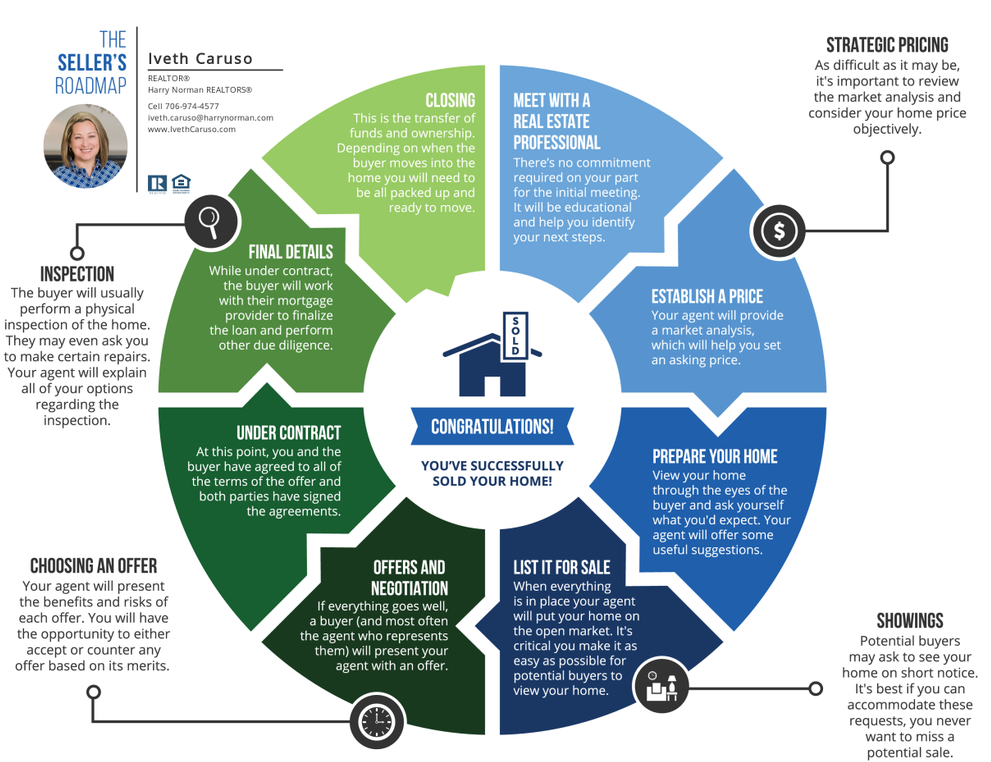

Steps to Sell a House with a Mortgage

1. Check Your Mortgage Balance

Contact your lender to find out your current payoff amount and any potential fees (like prepayment penalties).

2. Determine Your Equity

Equity = Home Value – Mortgage Balance

If you have positive equity, the sale should be straightforward.

3. Hire a Real Estate Agent or List Your Home

Decide whether to work with an agent or sell your home yourself (FSBO).

4. Accept an Offer and Enter Escrow

Once you accept an offer, the transaction moves into escrow, where title and loan payoff details are finalized.

5. Pay Off the Mortgage at Closing

At closing, the buyer’s funds will first pay off your mortgage. Any surplus goes to you.

Can You Sell Without Paying Off the Mortgage?

No — when you sell a house, the mortgage must be paid off as part of the closing process. This is because the mortgage is secured by the property, and the lender holds a lien on it until the loan is repaid.

What If You Owe More Than the House Is Worth?

If you’re upside-down on your mortgage (you owe more than the home is worth), you have options:

- Negotiate a short sale with your lender

- Wait for the market to improve

- Rent the home until you build equity

A short sale requires lender approval and typically involves selling the home for less than what you owe.

Can Someone Take Over Your Mortgage Instead?

Most mortgages include a due-on-sale clause , which means the loan must be paid in full when the property is sold. However, some loans — like FHA , VA , and USDA loans — may be assumable , allowing a qualified buyer to take over the mortgage.

Final Thoughts

Yes, you can absolutely sell a house with a mortgage — it’s a common and perfectly legal process. Just make sure to understand your financial situation, communicate with your lender, and work with a real estate professional to ensure a smooth transaction.

Selling your home can be the start of a new chapter — and with the right planning, it can also be financially rewarding.

Frequently Asked Questions (FAQs)

Q1: Do I have to pay off my mortgage when I sell my house?

Yes, the mortgage is typically paid off using the proceeds from the sale during the closing process.

Q2: Can I sell my house if I’m behind on mortgage payments?

Yes, but you’ll likely need to work with your lender and may consider a short sale if you’re underwater.

Q3: Can someone take over my mortgage instead of selling?

In rare cases, yes — especially with FHA, VA, or USDA loans. Most conventional mortgages require full repayment upon sale.

Join The Discussion