If you’re searching online for “house for mortgage near me” , you’re likely ready to take the next step toward homeownership. Whether you’re a first-time buyer or looking to move closer to work, family, or better schools, finding a home that fits your budget and mortgage options is key.

In this post, we’ll guide you through:

- How to find houses for sale in your area

- Why getting pre-approved matters

- The best tools and platforms to search for mortgage-friendly homes

- Tips to buy smartly in today’s market

Let’s get started.

Step 1: Understand What “House for Mortgage” Really Means

When people say “house for mortgage near me” , they usually mean:

🔍 A home available for purchase that can be financed with a mortgage — not just cash-only listings.

This includes most traditional homes listed on real estate platforms, as long as they meet lender requirements like:

- Being in good structural condition

- Having clear title

- Not being in a high-risk zone without proper insurance

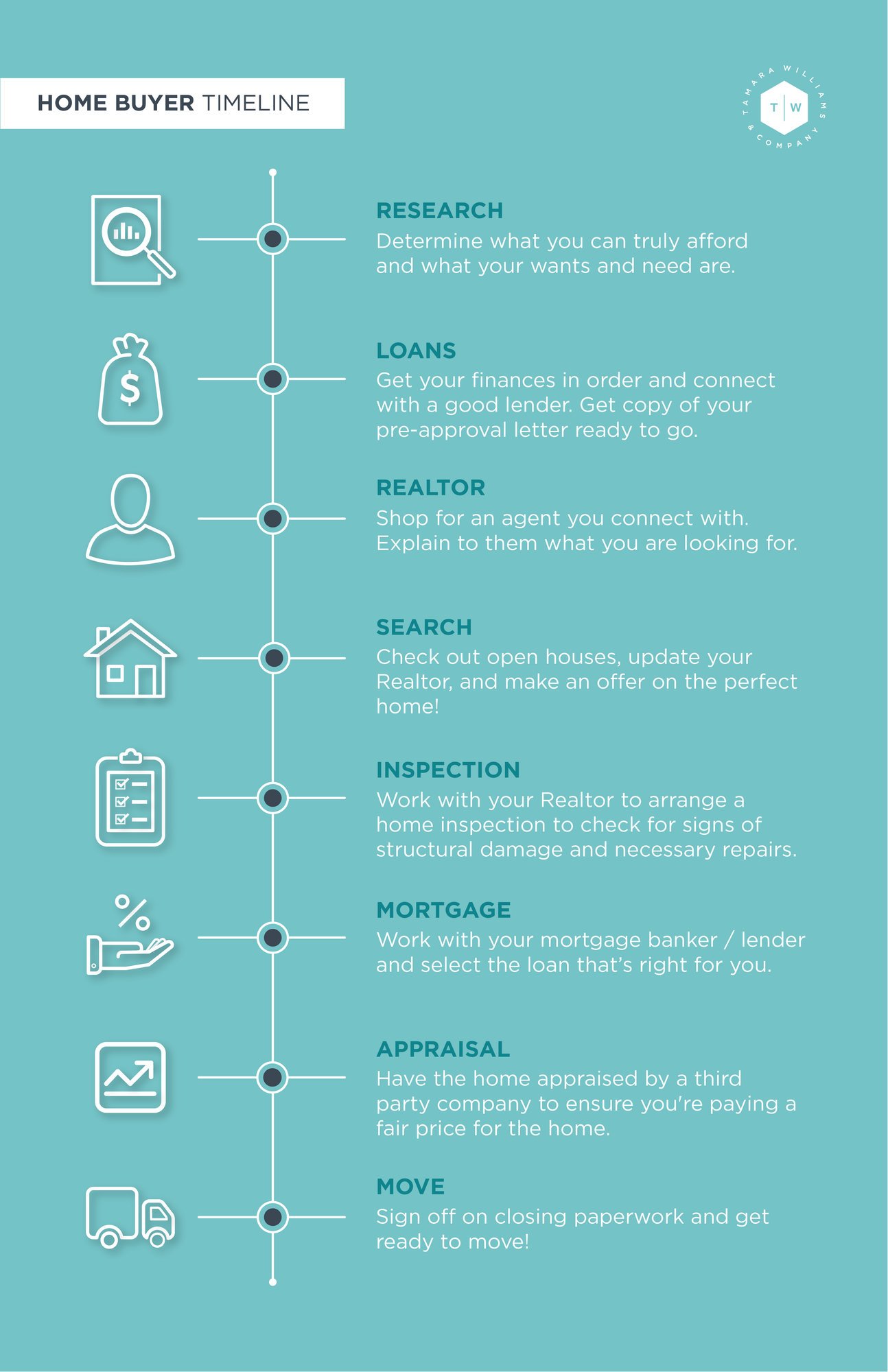

Step 2: Get Pre-Approved for a Mortgage

Before you start browsing homes, it’s crucial to get pre-approved by a mortgage lender. This gives you:

- A clear budget range

- More credibility with sellers

- Faster closing once you make an offer

To get pre-approved, you’ll need to provide:

- Proof of income (pay stubs, tax returns)

- Bank statements

- ID and Social Security number

- Credit authorization

Once approved, you’ll know how much house you can afford and which loan types fit your situation.

Step 3: Search for Houses for Mortgage Near You

Here are the best platforms to find houses for sale that accept mortgages :

| Zillow | Nationwide listings, mortgage calculators, and Zestimate values |

| Redfin | Real-time updates, local agent support, and low-commission agents |

| ** Realtor.com ** | Accurate MLS data and detailed property history |

| Trulia | Great for neighborhood insights and local school info |

| Rocket Homes | Integrated with Quicken Loans for easy mortgage access |

You can also search by location using phrases like:

- “Homes for sale with mortgage [City/Zip Code]”

- “Mortgage-approved homes near me”

Step 4: Work With a Local Real Estate Agent

Even if you’re comfortable searching online, working with a local real estate agent can help you:

- Find off-market deals

- Negotiate better terms

- Avoid homes with hidden issues

- Navigate mortgage paperwork smoothly

Most agents work for free — their commission comes from the seller, not you.

Step 5: Know What Lenders Look For in a Home

Not all houses qualify for a mortgage. Here’s what lenders typically require:

| Clear Title | Must have no legal disputes or liens |

| Appraisal Value | Home must appraise at or above purchase price |

| Structural Soundness | No major foundation, roof, or electrical issues |

| Minimum Down Payment | Varies by loan type (FHA = 3.5%, Conventional = 5–20%) |

If a home doesn’t meet these standards, your mortgage application could be denied.

Final Thoughts

Yes, you can absolutely find a house for mortgage near you — whether you’re buying your first home or upgrading to something bigger. By getting pre-approved, using trusted platforms, and working with a local agent, you’ll be well on your way to owning a home that fits your budget and lifestyle.

Start your search today — and soon, you’ll be moving into a house that’s truly yours.

Frequently Asked Questions (FAQs)

Q1: Can I buy any house with a mortgage?

Most homes qualify, but they must meet lender standards for appraisal, title, and condition.

Q2: How do I find houses that accept mortgage loans?

Use platforms like Zillow, Redfin, or Realtor.com and filter for listings in your budget range.

Q3: Do I need a down payment to buy a house with a mortgage?

Yes, though some loans (like FHA or VA) allow very low or no down payment depending on eligibility.

Join The Discussion