One of the most important questions when buying a home is: “How much house can I afford?” The answer depends on several factors — including your income, credit score, down payment, and current mortgage rates.

To help you get a clear picture, we’ve put together an easy-to-use mortgage affordability calculator , along with a breakdown of how it works.

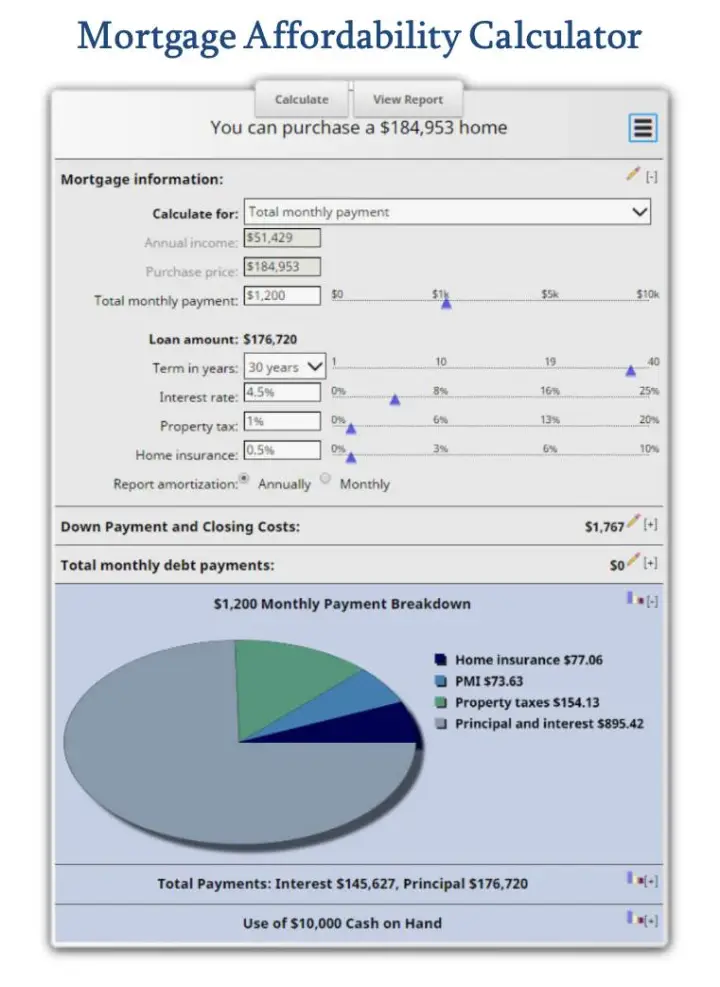

Mortgage Calculator – Estimate Your Monthly Payment

Here’s a quick online-style mortgage calculator you can use:

- 🏠 Home Price: $__________

- 💵 Down Payment (%): _______%

- 📉 Interest Rate (%): _______%

- 📅 Loan Term: 15 / 20 / 30 years

- 🏡 Property Taxes: $__________/yr

- 🛡️ Home Insurance: $__________/yr

- 🧾 PMI (if <20% down): Yes / No

👉 Calculate Estimated Monthly Payment : $.

(Note: You can turn this into an actual interactive tool using WordPress plugins or embed code from platforms like Zillow or Bankrate later.)

How the Mortgage Calculator Works

Our calculator estimates your total monthly mortgage payment , which typically includes:

| Principal & Interest | Based on loan amount, interest rate, and term. |

| Property Taxes | Varies by location; often included in monthly payments. |

| Homeowners Insurance | Required by lenders to protect the property. |

| PMI (Private Mortgage Insurance) | Required if your down payment is less than 20%. |

Key Factors That Affect How Much House You Can Afford

1. Your Income

Lenders look at your gross monthly income to determine how much you can borrow.

2. Debt-to-Income Ratio (DTI)

Most lenders prefer a DTI below 43% , though some allow up to 50% depending on credit and other factors.

3. Credit Score

A higher credit score can qualify you for lower interest rates, increasing affordability.

4. Down Payment

The larger your down payment, the smaller your loan — and the better your chances of avoiding PMI.

5. Current Mortgage Rates

Even a small change in interest rates can significantly impact your monthly payment.

Rule of Thumb: How Much House Can I Afford?

- 28% Rule : Your housing payment shouldn’t exceed 28% of your gross monthly income .

- 36% Rule : Total debt payments (including mortgage, car loans, credit cards) should stay under 36% of your gross income .

Example:

If you earn $7,000/month:

- Max mortgage payment = 28% × $7,000 = $1,960

- Max total debt payment = 36% × $7,000 = $2,520

Final Thoughts

Using a mortgage calculator is one of the best ways to understand how much house you can afford before starting your home search. By entering your income, down payment, and expected interest rate, you’ll get a realistic idea of your budget — and avoid falling in love with a home you can’t actually buy.

Always remember to factor in taxes, insurance, and other costs that affect your monthly payment.

Frequently Asked Questions (FAQs)

Q1: What is the best mortgage calculator online?

There are many great tools, including calculators from Zillow, Bankrate, and Google Finance. For basic use, even Excel or a simple mobile app works.

Q2: How accurate are mortgage calculators?

They provide a close estimate but don’t include all variables like HOA fees or special assessments. Always confirm with a lender.

Q3: Can I calculate my mortgage without taxes and insurance?

Yes, but keep in mind that lenders usually require you to pay these as part of your monthly payment.

Join The Discussion