Introduction

Investing in real estate in California can be one of the most rewarding financial decisions—if done right. Despite its high home prices, the Golden State offers strong opportunities for rental income, appreciation, and portfolio growth.

In this guide, you’ll learn:

- Why California is still a great place to invest

- Top investment strategies (buy-and-hold, flipping, wholesaling)

- Best cities for real estate investors

- Steps to get started

Let’s walk through how to begin investing in real estate in California.

Why Invest in California Real Estate?

California remains a top destination for real estate investors due to:

- Strong population and job growth

- Limited land supply driving long-term appreciation

- High demand for rentals

- Diverse economy and growing remote work trends

Even with higher entry costs than many states, the potential for long-term gains makes it worth considering.

Top Investment Strategies in California

There are several ways to invest in California real estate:

1. Buy-and-Hold Rentals

Purchase property and rent it out for monthly cash flow and appreciation.

Best for : Long-term wealth building, passive income seekers

2. House Flipping

Buy distressed properties, renovate, and sell for profit.

Best for : Active investors with renovation experience

3. Wholesaling

Find off-market deals and assign contracts to end buyers for a fee—no need to own the property.

Best for : Low-capital entry into real estate

4. Vacation Rentals

Buy homes in tourist-friendly areas like Lake Tahoe or Newport Beach and rent short-term.

Best for : Tech-savvy investors and Airbnb hosts

5. Commercial Real Estate

Invest in office buildings, retail spaces, or industrial warehouses.

Best for : Experienced investors seeking higher returns

Best Cities to Invest in California (2025)

Some cities offer better value, rental yield, and growth potential than others.

| Sacramento | $560,000 | $2,400/month | Growing population, affordable entry point |

| Fresno | $410,000 | $1,900/month | High cash-on-cash returns |

| Bakersfield | $390,000 | $1,800/month | Strong tenant retention |

| Inland Empire (Riverside/San Bernardino) | $430,000 | $2,200/month | Logistics boom drives investor interest |

| Modesto | $430,000 | $2,000/month | Family-friendly and growing |

These cities provide more affordable access to California’s real estate market while offering solid returns.

Step-by-Step: How to Start Investing in California

Step 1: Set Clear Goals

Decide whether you want cash flow , appreciation , or both.

Step 2: Choose a Strategy

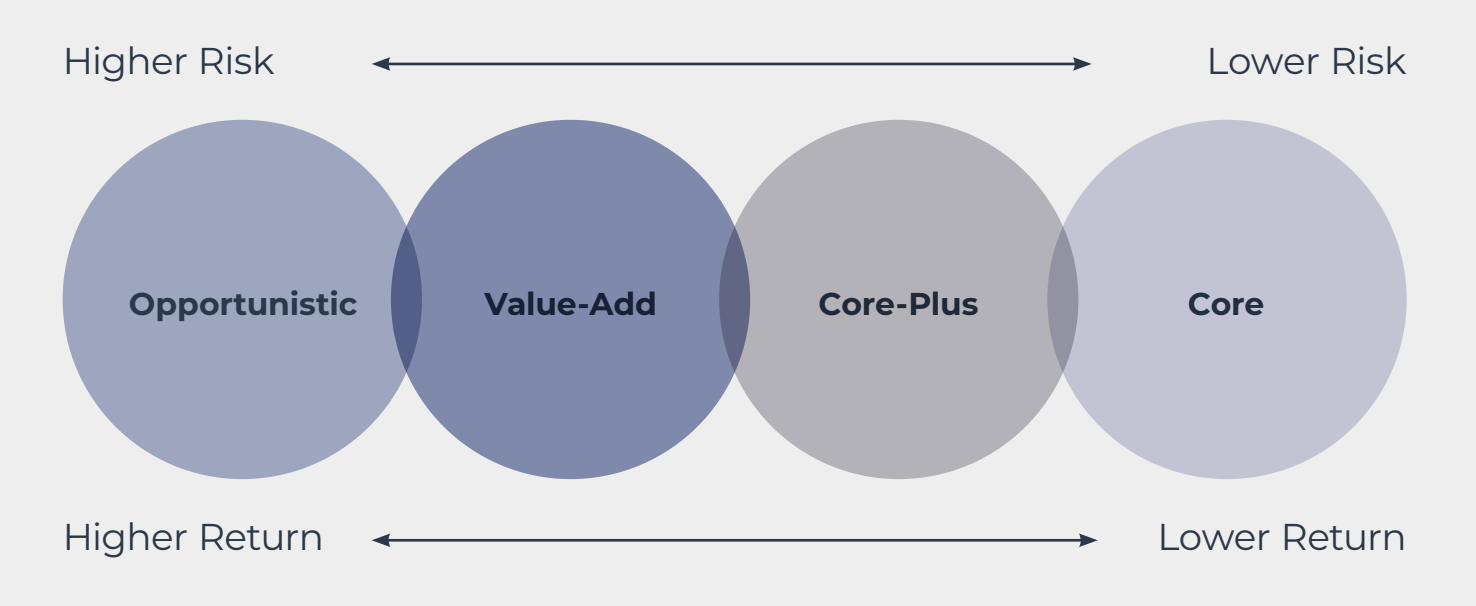

Pick an investment style that fits your budget, timeline, and risk tolerance.

Step 3: Research Markets

Focus on cities with strong job growth, rising rents, and lower-than-average prices.

Step 4: Secure Financing

Explore:

- Traditional mortgages

- Hard money loans

- Private lenders

- FHA/VA loan programs

- Cash purchases

Step 5: Build a Team

You’ll need:

- Local real estate agent

- Property manager (if renting)

- Lender or mortgage broker

- Attorney or title company

Step 6: Find Deals

Use:

- MLS listings

- Off-market deals

- Wholesalers

- Auctions

- Direct mail campaigns

Step 7: Analyze & Buy

Calculate cash flow, cap rate, and ROI before making an offer.

Common Mistakes to Avoid

Avoid these early errors:

- Overpaying for property

- Underestimating repair costs

- Not researching local laws (rent control, zoning)

- Skipping inspections

- Ignoring operating expenses

Future Outlook for California Real Estate Investors

Experts predict continued appreciation in most California markets over the next five years. Remote work trends, infrastructure investments, and limited housing supply support ongoing demand.

Smart investors who focus on affordable secondary markets will likely see strong returns.

Conclusion

Learning how to invest in real estate in California opens the door to long-term wealth building. Whether you’re buying rentals, flipping houses, or wholesaling deals, success comes from education, planning, and working with trusted professionals.

Start small, stay informed, and scale smartly—and California’s dynamic market can work for you.

Frequently Asked Questions (FAQs)

Q: Is now a good time to invest in California real estate?

A: Yes—especially in inland and secondary markets where prices are more affordable.

Q: Can I invest in California real estate with no money down?

A: It’s rare, but possible through creative methods like wholesaling, lease options, or joint ventures.

Q: What is the best city to invest in California?

A: That depends on your goals. Sacramento, Fresno, Bakersfield, and the Inland Empire are top choices.

Join The Discussion