Introduction

The California real estate market in 2023 was defined by shifting conditions—rising mortgage rates, cooling demand, and growing interest in more affordable cities. While coastal areas remained expensive, secondary markets saw increased buyer and investor activity.

In this post, we’ll cover:

- Key real estate trends from 2023

- Price movements and affordability

- Top performing regions

- What homebuyers and investors should know

Let’s take a look back at how the California housing market evolved in 2023.

California Housing Market Overview (2023)

2023 brought a mix of challenges and opportunities for buyers, sellers, and investors.

Key Highlights:

- Median Home Price : $750,000 (down slightly from 2022)

- Inventory : Tight supply with only 1.8 months of inventory

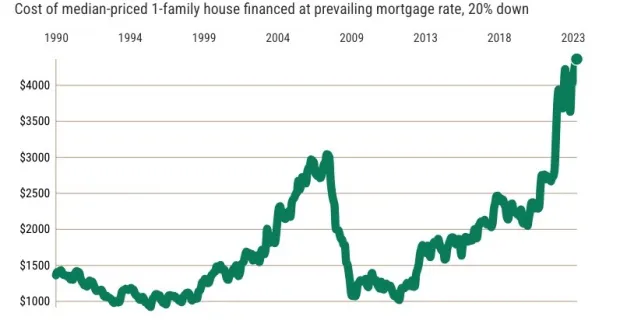

- Mortgage Rates : Peaked near 7%, causing slowdown in sales

- Sales Volume : Down ~8% YoY due to high borrowing costs

- Rental Growth : Slowed to +2.5% as new construction added supply

Despite the cooling, California’s long-term fundamentals—limited land, strong job centers, and population growth—remained intact.

Top Performing Markets in 2023

While some coastal markets cooled, inland and suburban areas gained momentum.

| Sacramento | $540,000 | $2,300/month | State capital saw steady demand |

| Fresno | $400,000 | $1,850/month | Strong cash-on-cash returns |

| Bakersfield | $380,000 | $1,750/month | Rising popularity among first-time buyers |

| Inland Empire (Riverside/San Bernardino) | $420,000 | $2,100/month | Logistics boom drove investor interest |

| Oakland | $840,000 | $2,900/month | Market softened but remained competitive |

These cities offered better value while still benefiting from proximity to major job hubs.

Key Factors That Shaped 2023

Several economic and policy shifts influenced the California real estate landscape:

| High Mortgage Rates | Slowed buyer demand and refinancing |

| Tight Inventory | Limited choice for buyers, kept prices elevated |

| Remote Work Migration | Buyers moved further from urban cores |

| Statewide Rent Caps | Affected investor returns in select cities |

| Wildfire Insurance Issues | Increased costs in fire-prone zones |

Price and Sales Trends Over the Year

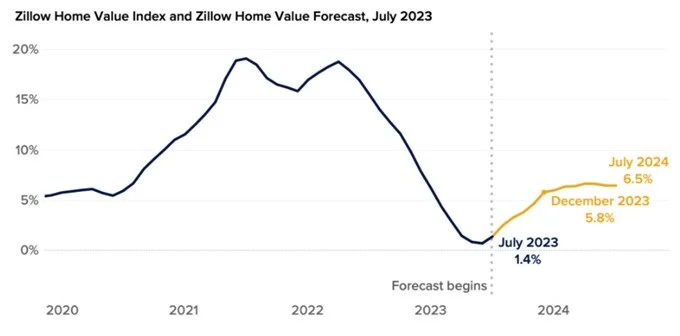

Early 2023 saw continued price declines from late 2022 peaks, but values stabilized by mid-year.

- Q1 : Median price = $690,000

- Q2 : $720,000

- Q3 : $750,000

- Q4 : $760,000

Sales dropped compared to 2022 due to rising loan costs, but all-cash buyers and investors helped maintain market stability.

Lessons for Buyers and Investors

For Buyers:

- Timing matters : The first half of the year offered better negotiation power.

- Look inland : More affordable options exist outside coastal cities.

- Get pre-approved : Competitive offers stood out in tight markets.

For Investors:

- Focus on rentals : Demand remained strong despite slower appreciation.

- Wholesaling thrived : Motivated sellers created off-market opportunities.

- Be cautious with flips : Higher financing and rehab costs cut into margins.

Conclusion

The real estate in California 2023 showed resilience despite rising mortgage rates and slowing sales. While coastal cities stayed pricey, secondary markets like Sacramento , Fresno , and the Inland Empire emerged as smart choices for both homeowners and investors.

Understanding the lessons from 2023 can help you make informed decisions in the years ahead.

Join The Discussion