Introduction

In the world of real estate investing , one of the most powerful yet misunderstood strategies is the “subject to” real estate deal . This method allows investors to take over a property without obtaining a new mortgage , making it ideal for those looking to build wealth quickly and with less capital.

California’s high home prices and competitive market make subject-to transactions an attractive option for savvy investors who understand how to navigate this strategy legally and profitably.

In this guide, you’ll learn:

- What “subject to” means in real estate

- How subject-to deals work in California

- Legal considerations and risks

- When to use this strategy

- Step-by-step process for structuring a subject-to deal

Let’s dive into the world of subject to real estate in California .

What Does “Subject To” Mean in Real Estate?

A “subject to” real estate transaction occurs when a buyer takes ownership of a property subject to the existing mortgage , meaning the original loan remains in place and the seller does not pay off the lender at closing.

The buyer assumes control of the payments but does not formally qualify for or apply for a new loan .

This is different from a traditional purchase where the buyer gets a new mortgage and the seller pays off their existing loan.

How Does a Subject-To Deal Work?

Here’s a simple breakdown:

- Seller Motivation : The seller wants to exit the property quickly—often due to financial hardship.

- Negotiate Purchase Price : Investor offers less than market value and agrees to assume responsibility for the mortgage.

- No Loan Assumption Approval Needed : The investor doesn’t get approved by the lender—they simply start making payments.

- New Deed, Same Mortgage : The property title is transferred to the buyer, but the original mortgage stays in the seller’s name.

- Investor Makes Payments : Investor begins paying the mortgage directly to the lender.

- Profit Strategy : Investor may rent out the property, flip it, or refinance later.

Is Subject-To Real Estate Legal in California?

Yes, subject-to transactions are legal in California , as long as they’re structured properly and all parties understand the terms.

However, there are important legal and financial risks to consider:

Key Legal Considerations:

- Due-on-Sale Clause : Most mortgages include a clause that allows the lender to call the loan due upon transfer of title. In practice, lenders rarely enforce this unless payments stop.

- Title Transfer Required : The deed must be transferred to the new buyer through escrow or a quitclaim deed.

- Seller Liability Remains : The original borrower remains legally responsible for the loan—even if the investor agrees to pay it.

- No Lender Approval Needed : Unlike loan assumption, subject-to deals don’t require lender consent.

Why Investors Use Subject-To Deals in California

Subject-to real estate is popular among investors because it allows them to:

- Buy property with little or no money down

- Avoid credit checks or income verification

- Take control of properties quickly

- Preserve credit and borrowing power

- Secure below-market deals from motivated sellers

It’s especially useful for investors who want to scale without taking on new debt.

Top Markets for Subject-To Deals in California (2025)

Some cities offer more opportunities due to higher levels of distressed homeowners and motivated sellers.

| Los Angeles | $960,000 | High | Large population, many equity-rich sellers |

| Sacramento | $560,000 | High | Growing investor presence and affordable entry points |

| Fresno | $410,000 | Very High | Strong cash-flow potential and motivated sellers |

| Bakersfield | $390,000 | High | Affordable homes and rising demand |

| Oakland | $850,000 | Medium-High | Urban investment opportunities with equity-rich properties |

Who Can Benefit from Subject-To Real Estate?

Ideal For:

- First-time investors with limited credit or funds

- Wholesalers looking to assign deals or hold for rental income

- Landlords seeking to grow their portfolio without qualifying for new loans

- Flippers wanting to avoid new financing delays

Step-by-Step Guide: How to Do a Subject-To Deal in California

Step 1: Find a Motivated Seller

Look for owners facing:

- Financial hardship

- Divorce

- Relocation

- Inheritance issues Use direct mail, driving for dollars, or online lead generation.

Step 2: Negotiate the Deal

Offer below market value. Explain the benefits to the seller:

- Quick exit

- No repairs needed

- No realtor fees

Step 3: Structure the Agreement

Use a purchase agreement that clearly states:

- The buyer is taking the property “subject to existing financing”

- The seller remains liable for the loan

- Buyer will make payments moving forward

Tip : Always consult with a real estate attorney before finalizing the contract.

Step 4: Transfer the Title

File a new deed (typically a Grant Deed) transferring ownership to the buyer. This can be done through escrow or private sale.

Step 5: Begin Making Payments

Once the deal closes, the investor starts making mortgage payments directly to the lender.

Step 6: Add Value or Generate Income

Options include:

- Renting the property

- Flipping after refinancing

- Holding long-term for appreciation

Risks Involved in Subject-To Transactions

While subject-to deals can be profitable, they also carry risk:

| Lender Calls Loan Due | Rare, but possible under the due-on-sale clause |

| Seller Credit Impact | Missed payments hurt the seller’s credit |

| Legal Missteps | Improperly structured deals can result in disputes |

| Escrow Confusion | Not all title companies understand or accept subject-to deals |

| Exit Challenges | Refinancing or selling can be harder with subject-to loans |

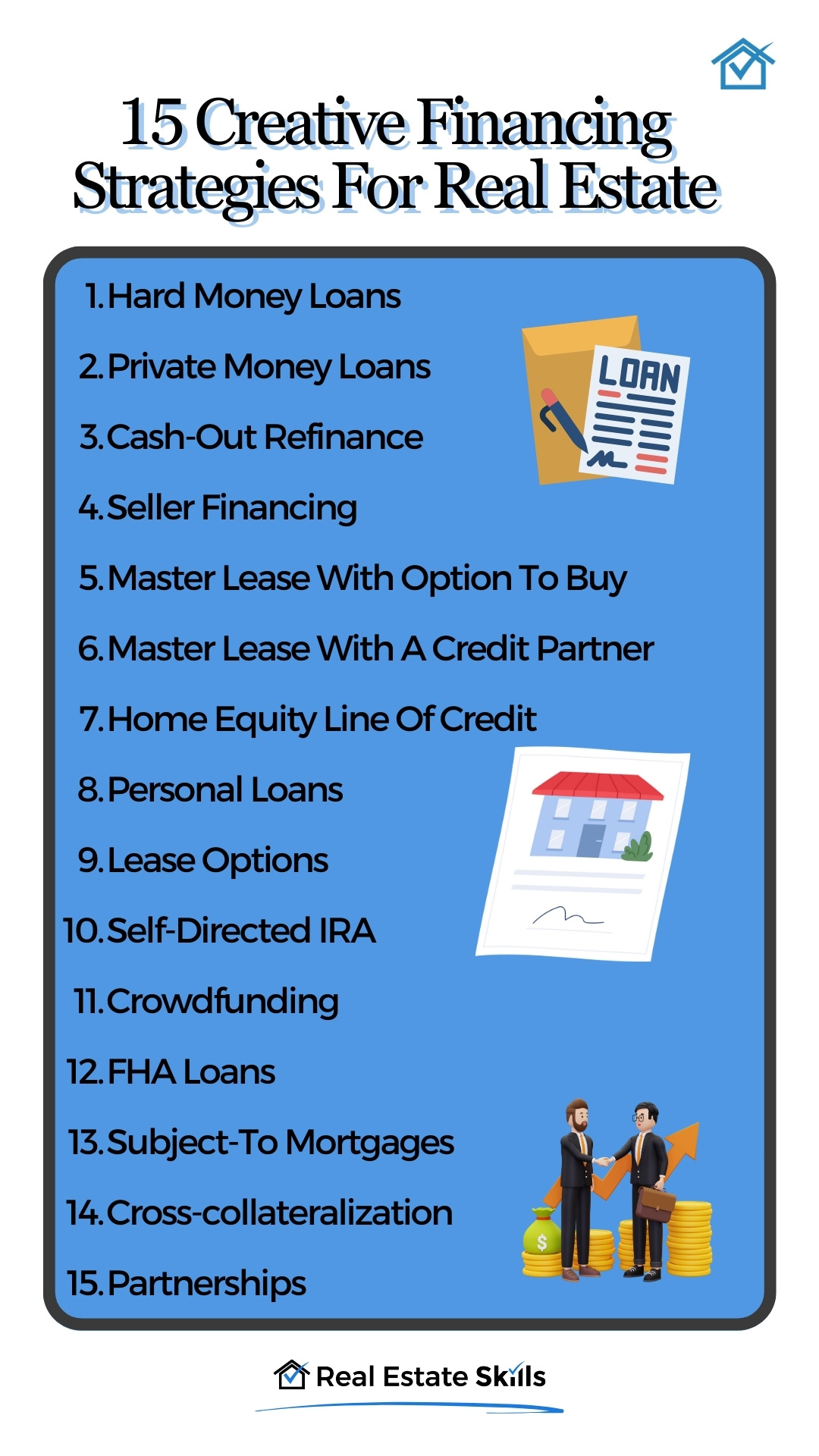

Subject-To vs. Other Creative Financing Methods

| Subject-To | Take over payments; loan stays in seller’s name | Low barrier to entry | Seller liability remains |

| Lease Option | Lease with right to buy later | Time to secure financing | Complex contracts |

| Owner Financing | Seller acts as the bank | Easier exit path | Requires seller cooperation |

| Hard Money Loan | Short-term financing | Fast access to capital | High interest rates |

Tips for Success with Subject-To Real Estate in California

- Work With a Real Estate Attorney – Ensure your contract protects both parties.

- Verify the Loan Terms – Know the balance, payment amount, and any balloon clauses.

- Build Trust with Sellers – Be transparent about how the deal works.

- Document Everything – Use clear agreements and keep records of all communications.

- Plan Your Exit Strategy – Whether renting, flipping, or refinancing, have a plan.

Case Study: A Successful Subject-To Deal in Sacramento

Scenario :

- Property: Single-family home in North Sacramento

- Seller: Retired couple downsizing; behind on payments

- Purchase Price: $420,000

- Existing Loan Balance: $300,000

- Investor Equity: Took over payments, made improvements, now rents for $2,200/month

Future Outlook for Subject-To Real Estate in California

With rising interest rates and tighter lending standards, more buyers are turning to creative financing options like subject-to deals . As remote work continues to reshape housing demand, subject-to strategies offer flexibility for investors to acquire properties without going through traditional banks.

Experts expect continued growth in alternative financing methods, especially in affordable secondary markets like Fresno, Bakersfield, and the Inland Empire.

Conclusion

Subject to real estate in California is a powerful tool for investors willing to think creatively. While it comes with certain risks—especially for the seller—it can provide excellent opportunities for buyers who lack traditional financing or want to move fast.

By understanding how these deals work, working with professionals, and being transparent with sellers, you can successfully use the subject-to strategy to grow your real estate portfolio.

Frequently Asked Questions (FAQs)

Q: Is subject-to real estate legal in California?

A: Yes, as long as the transaction is structured correctly and recorded properly.

Q: Does the seller still owe money in a subject-to deal?

A: Yes, the seller remains legally responsible for the loan until it’s paid off.

Q: Can I refinance a subject-to property in California?

A: Yes, once you’ve built equity and improved your credit.

Q: Are subject-to deals safe for the buyer?

A: Yes—if you understand the risks and maintain consistent payments.

Join The Discussion