Introduction: What Are Capital Gains on Real Estate?

When you sell a property for more than its purchase price, the profit you make is known as a capital gain . In California , real estate capital gains are taxed at both the federal and state level , making it crucial for homeowners and investors to understand how these taxes apply.

Whether you’re selling a home, rental property, or vacant land, understanding capital gains can help you plan better and potentially save thousands in taxes.

How Are Capital Gains Calculated?

Capital gains are calculated by subtracting the adjusted cost basis from the net sales price :

Capital Gain = Net Sales Price – Adjusted Cost Basis

- Net Sales Price : Sale price minus selling expenses (like realtor fees, legal costs).

- Adjusted Cost Basis : Original purchase price + improvements – depreciation (for investment properties).

Let’s break this down with an example:

| Purchase Price | $500,000 |

| Improvements | $50,000 |

| Depreciation (Investment Property) | -$30,000 |

| Adjusted Cost Basis | $520,000 |

| Sale Price | $800,000 |

| Selling Expenses | -$20,000 |

| Net Sales Price | $780,000 |

| Capital Gain | $260,000 |

Federal vs. California State Tax Rates

In California, you’ll pay two layers of capital gains tax — one to the IRS and another to the California Department of Tax and Fee Administration .

🏛️ Federal Capital Gains Tax

The federal rate depends on your income and filing status :

| Up to $44,625 | 0% |

| $44,626 – $492,300 | 15% |

| Over $492,300 | 20% |

Short-term capital gains (properties held < 1 year) are taxed as ordinary income.

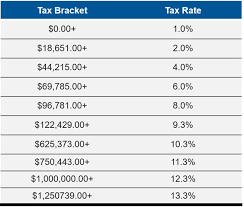

🌲 California Capital Gains Tax

California treats capital gains as regular income, meaning they are taxed at your marginal tax rate , which can be up to 12.3% (as of 2024). There is no separate lower rate for long-term gains like at the federal level.

| Highest Bracket | 12.3% |

So, if you’re in the top bracket, your total capital gains tax could be over 30% (federal + state combined).

Exemptions & Deductions That Can Help Reduce Your Tax Bill

Thankfully, there are several ways to reduce or defer capital gains taxes:

🏡 Primary Residence Exclusion (IRS Section 121)

If you’re selling your primary residence , you may qualify for a tax exclusion :

- Up to $250,000 in gains excluded for single filers

- Up to $500,000 in gains excluded for married couples filing jointly

To qualify:

- You must have lived in the home for at least 2 out of the last 5 years

- Cannot have used the exclusion in the past 2 years

This exemption applies only to principal residences , not investment properties.

📉 Depreciation Recapture (For Investment Properties)

If you depreciated an investment property over time, part of your gain may be taxed at higher recapture rates (up to 25%). However, you can defer this using a 1031 exchange .

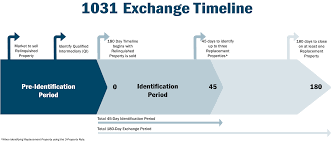

🔄 1031 Exchange (Like-Kind Exchange)

Under IRS rules, you can defer paying capital gains taxes by reinvesting the proceeds into a similar (“like-kind”) investment property within specific timeframes.

Note: As of 2024, 1031 exchanges are no longer allowed for personal property , but still apply to real estate investments .

Special Considerations in California

- No Step-Up in Basis for Inherited Property : Unlike some states, California does not add a step-up in basis for inherited property. This means heirs could face high capital gains if they later sell.

- High Home Values Mean Higher Gains : With California’s soaring property values, even modestly priced homes can generate large capital gains.

- Local Transfer Taxes : Some counties and cities (e.g., Los Angeles, San Francisco) impose additional transfer taxes when real estate changes hands. These don’t affect capital gains directly but increase transaction costs.

Tips to Minimize Capital Gains Tax in California

- Live in the Property for at Least Two Years to qualify for the primary residence exclusion.

- Track All Home Improvements to increase your cost basis.

- Use a 1031 Exchange if you’re an investor looking to defer taxes.

- Consult a Tax Professional familiar with California law before selling.

- Consider Timing Your Sale to manage taxable income across multiple years.

Conclusion

Understanding capital gains on real estate in California is essential whether you’re selling your home or managing investment properties. With the right planning and knowledge of available exclusions and deferrals, you can significantly reduce your tax liability.

Always consult with a qualified real estate attorney or tax professional to tailor a strategy that fits your situation.

Frequently Asked Questions (FAQ)

Q: Do seniors pay capital gains on home sales in California?

A: Yes, unless they qualify for the $250,000/$500,000 exclusion for primary residences.

Q: Is there a way to avoid capital gains tax on a second home in California?

A: If sold as a second home (not rented), you may not qualify for the full exclusion. A 1031 exchange may help if it was used as an investment.

Q: How long do I need to live in a house to avoid capital gains tax in California?

A: At least 2 out of the last 5 years before the sale.

Join The Discussion