If you’re thinking about buying a home or refinancing your current mortgage, one of the most important factors to understand is mortgage interest rates . But what exactly are house mortgage interest rates, and why do they matter? In this post, we’ll break it down simply and clearly.

What Are Mortgage Interest Rates?

A mortgage interest rate is the percentage charged by a lender on a home loan. It determines how much extra you’ll pay back over the life of the loan beyond the original amount you borrowed (the principal).

For example, if you take out a $300,000 mortgage at a 6% interest rate over 30 years, you’ll end up paying significantly more than $300,000 due to interest.

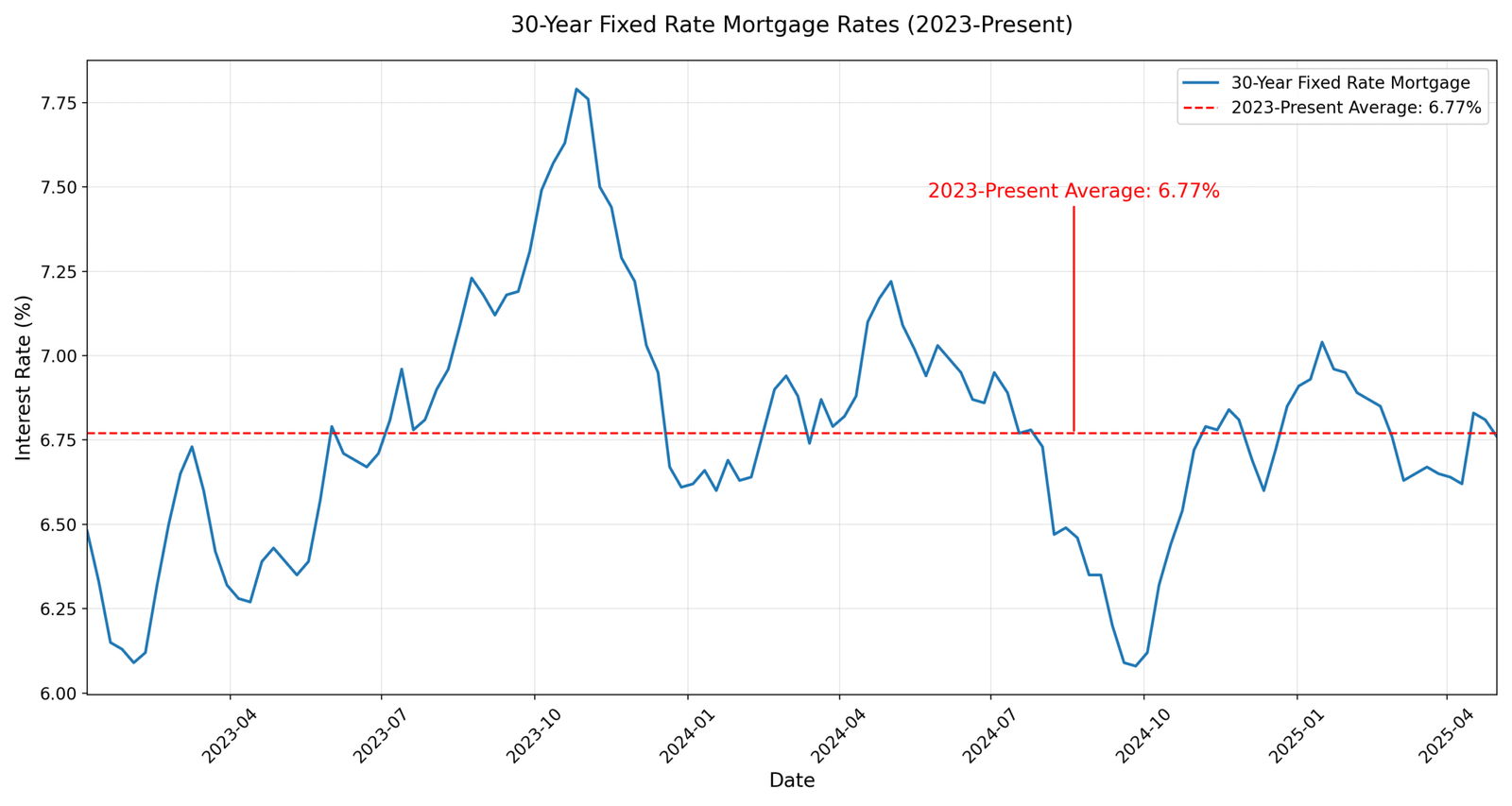

Current Mortgage Rates in 2025

As of early 2025 , here are the average mortgage interest rates in the U.S.:

| 30-Year Fixed | ~6.4% |

| 15-Year Fixed | ~5.7% |

| 5/1 Adjustable-Rate Mortgage (ARM) | ~5.2% |

These rates can vary depending on your credit score, down payment, location, and other market conditions.

Types of Mortgage Interest Rates

There are two main types of mortgage interest rates:

1. Fixed-Rate Mortgages

- The interest rate stays the same for the entire loan term.

- Most common for 15-, 20-, or 30-year loans.

- Offers stability and predictable monthly payments.

2. Adjustable-Rate Mortgages (ARMs)

- The rate is fixed for an initial period (e.g., 5 or 7 years), then adjusts annually based on market indexes.

- Often starts with a lower “introductory” rate.

- Riskier but can be beneficial if you plan to move or refinance before the rate adjusts.

What Determines Your Mortgage Rate?

Several key factors influence the mortgage rate you’ll receive:

- Credit Score : Higher scores usually get better rates.

- Loan Term : Shorter terms often have lower rates.

- Down Payment : A larger down payment may reduce your rate.

- Market Conditions : Economic trends, inflation, and Federal Reserve policies all play a role.

- Debt-to-Income Ratio (DTI) : Lower DTIs are seen as less risky.

How to Get the Best Mortgage Rate

Here are a few tips to help you secure a lower interest rate:

- Improve your credit score before applying.

- Save for a larger down payment.

- Shop around with multiple lenders.

- Consider a shorter loan term if affordable.

- Lock in your rate when it’s favorable.

Final Thoughts

Understanding what house mortgage interest rates are and how they work can help you make smarter financial decisions when buying or refinancing a home. With average rates hovering around 6.4% for a 30-year loan in 2025, now is still a good time to explore your options—especially if you’re prepared and have strong credit.

Join The Discussion