Introduction

If you’re planning to sell a home, investment property, or land in California, it’s essential to understand the capital gains tax on real estate in California . Failing to account for this tax can lead to unexpected costs at closing.

In this guide, we’ll explain:

- What capital gains tax is

- How it applies to real estate sales

- Federal and California state tax rates

- Exemptions and ways to reduce your tax bill

- Key strategies like the 1031 exchange

Let’s dive into everything you need to know about real estate capital gains taxes in California .

What Is Capital Gains Tax?

Capital gains tax is a tax on the profit you make when you sell an asset that has increased in value—such as stocks, land, or real estate.

When applied to real estate, capital gains = sale price – original purchase price (plus improvements and selling expenses) .

There are two types of capital gains:

| Short-Term | Property held less than one year | Taxed as ordinary income (up to 37%) |

| Long-Term | Property held more than one year | Taxed at lower rate (0%, 15%, or 20% federally) |

Capital Gains Tax on Real Estate in California: Key Facts

California taxes capital gains as ordinary income , regardless of how long you’ve owned the property.

California Capital Gains Tax Rates (2025):

- State Rate : Up to 13.3% (highest in the U.S.)

- Federal Rate : 0%, 15%, or 20% (depending on income)

- Net Investment Income Tax (NIIT) : Additional 3.8% on high-income earners

Example:

If you made a $200,000 gain on a property:

- Federal tax: ~$30,000 (assuming 15%)

- California tax: ~$26,600 (at 13.3%)

- NIIT: ~$7,600 (if applicable)

Total Estimated Tax: $64,200

Federal vs. California Capital Gains Tax

| Taxed as Ordinary Income | No (long-term gains taxed separately) | Yes |

| Top Tax Rate | 20% + 3.8% NIIT | 13.3% |

| Exemption for Primary Residence | Yes (up to $250k–$500k) | Yes (no CA tax on exempt amount) |

| 1031 Exchange Allowed | Yes | Yes (with restrictions) |

Do You Pay Capital Gains Tax When Selling a House in California?

Yes—if you sold a property not used as your primary residence , such as:

- Rental properties

- Vacation homes

- Land

- Flips or investment properties

However, if you lived in the home as your primary residence for at least 2 out of the last 5 years , you may qualify for the Primary Residence Exclusion .

Primary Home Exclusion:

- Single filers : Exclude up to $250,000 of gain

- Married couples filing jointly : Exclude up to $500,000

- Must meet IRS ownership and use tests

This exclusion can be used once every two years .

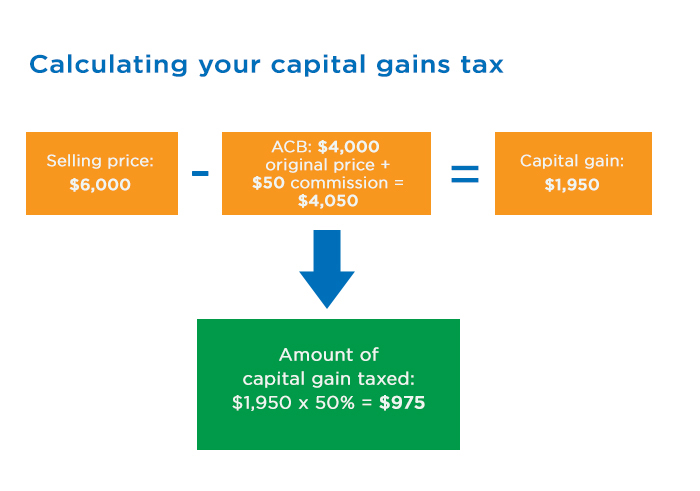

How to Calculate Capital Gains on Real Estate in California

Use this formula:

1

Capital Gain = Sale Price – Adjusted Basis

Where:

- Sale Price = Final selling price after commissions and fees

- Adjusted Basis = Purchase price + cost of major improvements – depreciation claimed (for rental properties)

Example:

- Sale Price: $1,000,000

- Purchase Price: $600,000

- Improvements: $50,000

- Depreciation (for rentals): $30,000

- Adjusted Basis : $620,000

- Capital Gain : $380,000

California Capital Gains Tax on Rental Property

Rental property owners must pay capital gains tax on:

- Appreciation

- Depreciation recapture

Depreciation Recapture:

The IRS “recaptures” depreciation taken during ownership and taxes it at 25% .

Example:

- $100,000 in claimed depreciation

- 25% recapture tax = $25,000 owed

Strategies to Reduce or Defer Capital Gains Tax in California

While you can’t avoid capital gains entirely, there are legal ways to reduce or defer the tax:

1. Live in the Property for 2 Years

Qualify for the primary residence exclusion of $250K–$500K.

2. 1031 Exchange (Like-Kind Exchange)

Defer capital gains tax by reinvesting proceeds into another investment property within 180 days.

Important Note : California now requires tax deferral compliance under the 2021 state law changes , so consult a qualified intermediary.

3. Installment Sales

Report part of the gain over multiple years by financing the buyer’s purchase.

4. Charitable Remainder Trusts

Donate appreciated property and receive income while deferring tax.

5. Offset Gains with Losses

Use capital losses from other investments to reduce taxable gains.

Does California Follow the Federal 1031 Exchange Rules?

Yes—but with a twist.

While the federal government allows full deferral of capital gains through a 1031 exchange , California does not . As of January 1, 2022, California defers the gain at the federal level but taxes it at the state level immediately unless specific relief applies.

This means:

- You can still defer federal tax

- But you must pay California tax in the year of sale , even if using a 1031 exchange

Always work with a qualified tax professional or CPA when doing exchanges in California.

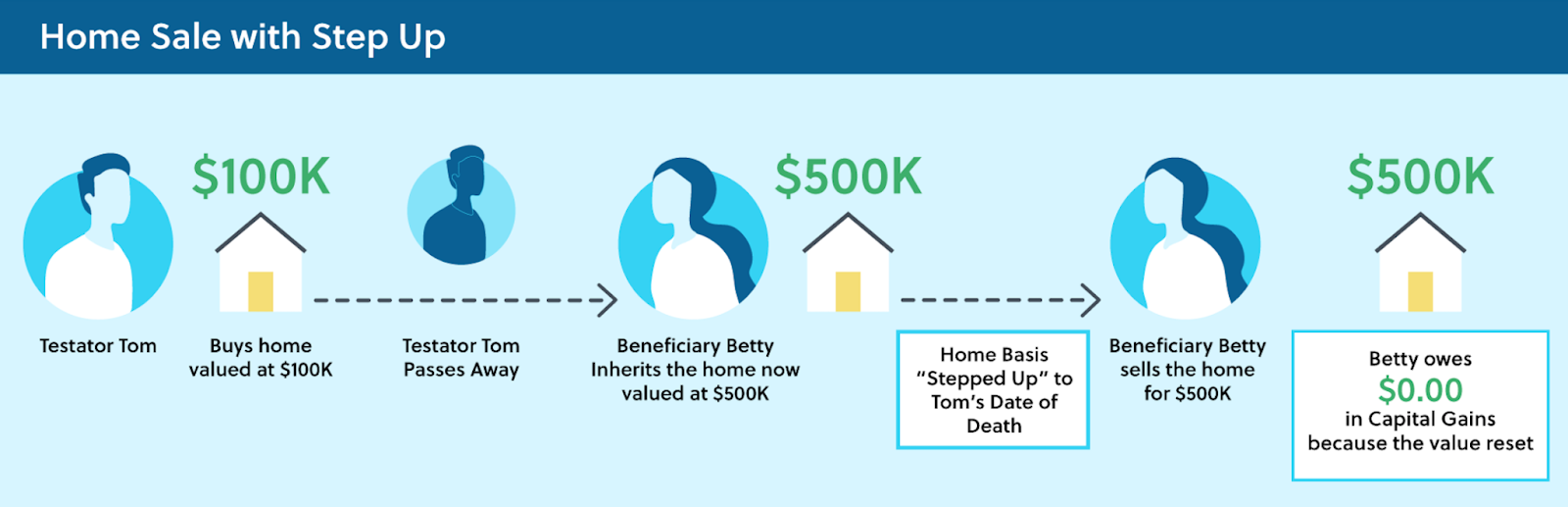

Special Considerations for Inherited Property

Inherited real estate gets a stepped-up basis , meaning the property’s value is reset to fair market value at the time of death.

Benefits:

- Minimal capital gains tax when you sell

- Great for heirs who sell inherited property

California Capital Gains Tax on Inherited Homes

| Sell inherited home quickly | Low or no gain due to stepped-up basis |

| Rent out inherited home | Subject to capital gains when sold |

| Live in inherited home | Can qualify for primary residence exclusion after 2 years |

California Capital Gains Tax on Land or Commercial Property

Land and commercial real estate are treated similarly to residential investment properties:

- Long-term gains taxed at up to 13.3% in California

- Depreciation recapture at 25%

- Available for 1031 exchange deferral (federal only)

California Capital Gains Tax on Second Homes or Vacation Properties

Second homes are treated like investment properties unless they also qualify as your primary residence .

To qualify for the $250K–$500K exclusion , you must live in the vacation home as your main home for at least two years before selling.

Otherwise, you’ll owe:

- Federal capital gains tax

- California capital gains tax

- Possibly NIIT (Net Investment Income Tax)

Summary of California Capital Gains Tax on Real Estate

| Primary Home | Exempt up to $250K–$500K | No CA tax on exempt gain | Must live in home for 2+ years |

| Investment/Rental Property | 15%–20% + 25% depreciation recapture | Up to 13.3% | Use 1031 exchange to defer (federal only) |

| Vacation Home | Varies | Varies | May qualify for primary home exclusion |

| Land | Varies | Up to 13.3% | No depreciation recapture |

| Inherited Property | Depends on holding period | Varies | Stepped-up basis often reduces or eliminates tax |

Future Outlook and Policy Changes

As of 2025, California maintains its top rate of 13.3% on capital gains, the highest in the nation.

There have been ongoing discussions in Sacramento about potential changes to real estate taxation, especially regarding:

- Tightening rules around 1031 exchanges

- Increasing taxes on high-income earners

- Reforming capital gains treatment for short-term rentals and tech buyers

Stay informed—tax laws can change annually.

Conclusion

Understanding the capital gains tax on real estate in California is crucial whether you’re selling your home, rental property, or vacant land. With the state’s top marginal rate reaching 13.3% , plus federal taxes, sellers should plan carefully to minimize their tax burden.

By taking advantage of exclusions, deferrals, and smart investment strategies, you can significantly reduce or delay your capital gains tax bill.

Frequently Asked Questions (FAQs)

Q: What is the capital gains tax on real estate in California?

A: California taxes capital gains as ordinary income, with rates up to 13.3% , depending on income.

Q: Do seniors pay capital gains on home sales in California?

A: Seniors can exclude up to $250,000 ($500,000 if married) if they lived in the home for 2 out of the last 5 years.

Q: How much is capital gains tax on investment property in California?

A: Combined federal and state rates can reach 30%–40% , including depreciation recapture.

Join The Discussion