It’s an important question — especially when it comes to inheritance, responsibilities, and what happens when the homeowner moves on.

In this post, we’ll explain clearly who owns the home during and after a reverse mortgage, and what heirs need to know.

Who Owns the House in a Reverse Mortgage?

✅ Short Answer:

You still own the house.

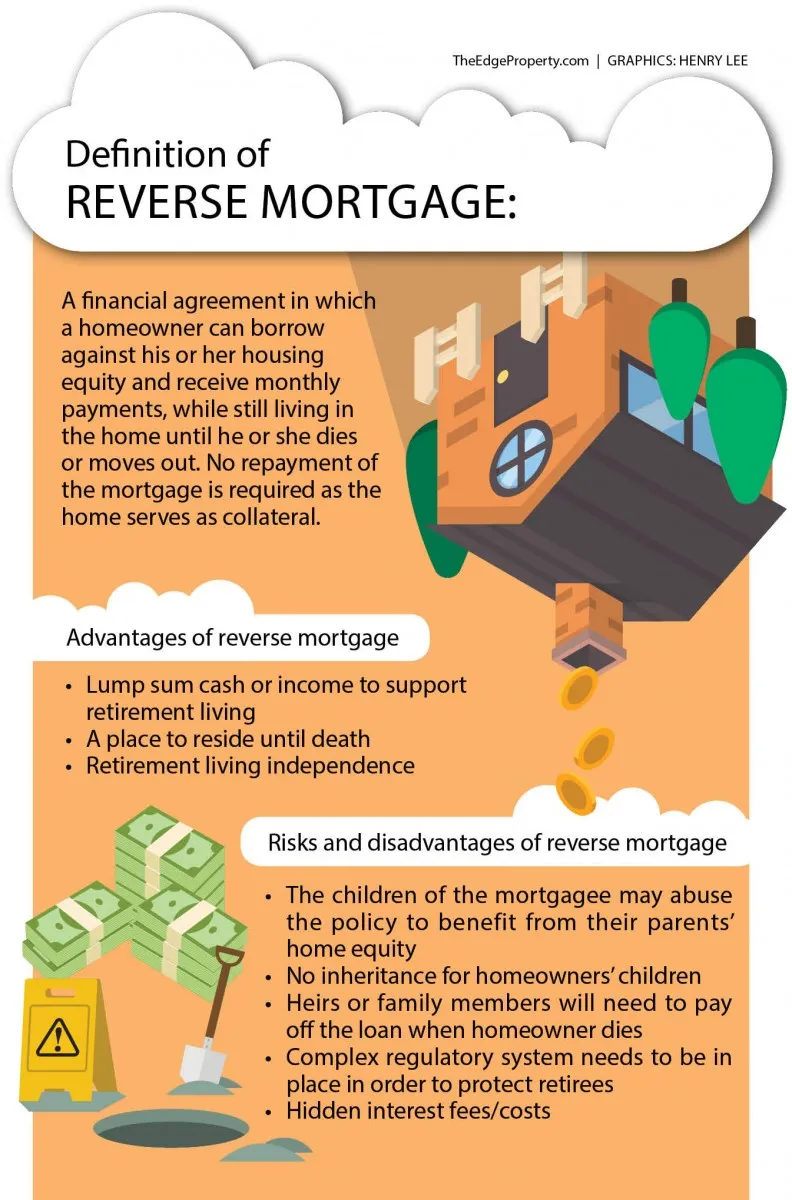

When you take out a Home Equity Conversion Mortgage (HECM) — the most common type of reverse mortgage — you remain the legal owner of your home .

The lender does not take ownership. Instead, they provide you with payments (or a line of credit) based on the equity in your home, and the loan is repaid later — usually when the home is sold or no longer your primary residence.

How a Reverse Mortgage Works

Here’s a quick breakdown:

- You apply for a reverse mortgage through an FHA-approved lender.

- You keep the title to your home and continue to live in it as your primary residence.

- You receive payments from the lender in the form of:

- A lump sum

- Monthly payments

- A line of credit

- Or a combination of these

- No monthly mortgage payments are required , as long as you meet the loan obligations (like paying taxes and insurance).

- The loan becomes due when:

- You move out permanently

- You sell the home

- You pass away

What Happens When the Homeowner Dies?

Even though the homeowner passes away, ownership remains with the estate or heirs . Here’s what happens next:

- The heirs can choose to keep the home by repaying the reverse mortgage balance (or 95% of the home’s appraised value, whichever is less).

- If they don’t want the house, they can sell it , and any remaining equity after paying off the loan goes to them.

- If the home is worth less than the loan balance , the lender absorbs the loss — the heirs are not responsible for the difference thanks to the non-recourse clause .

Responsibilities of the Homeowner

Even though you own the home, you must continue to:

- Pay property taxes

- Keep homeowners insurance

- Maintain the property

- Live in the home as your primary residence

Failing to meet these requirements could trigger loan repayment.

Final Thoughts

Yes, you still own your house with a reverse mortgage . It remains yours — or your heirs’ — even as you receive payments from the lender.

A reverse mortgage allows seniors to stay in their homes while converting equity into cash, without giving up ownership. However, understanding the rules and planning for the future is key to making the most of this financial tool.

Frequently Asked Questions (FAQs)

Q1: Do I still own my home with a reverse mortgage?

Yes, you retain ownership of your home throughout the life of the reverse mortgage.

Q2: Can I leave my house to my children with a reverse mortgage?

Yes, your heirs can inherit the home and choose to keep it or sell it after repaying the loan.

Q3: What happens if the loan balance is more than the home is worth?

Your heirs only owe up to 95% of the home’s appraised value. Any excess debt is forgiven by the lender.

Join The Discussion