If you’ve recently checked your mortgage statement and noticed that your monthly payment has gone up, you’re not alone. Many homeowners ask: “Why did my house mortgage go up?”

The answer can vary depending on your loan type, location, and market conditions. In this post, we’ll break down the most common reasons your mortgage payment might increase — and what you can do about it.

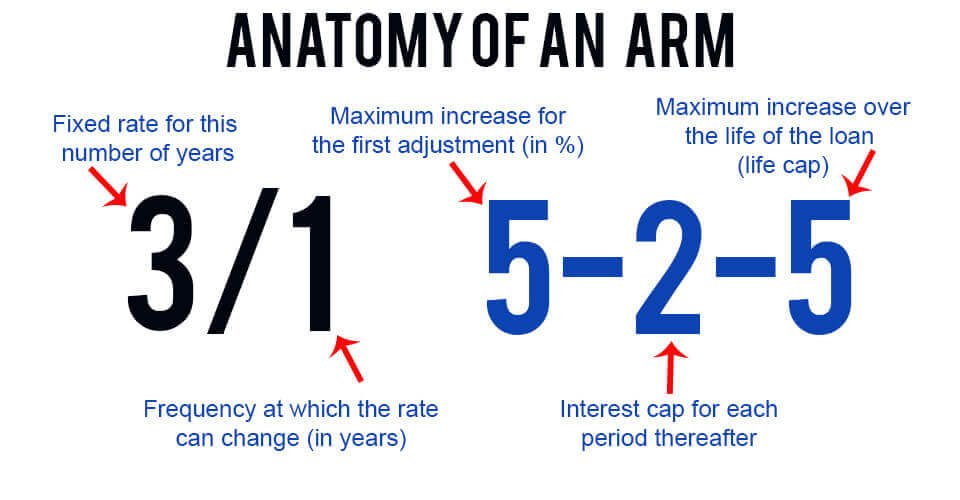

1. Your Interest Rate Went Up (If You Have an ARM)

If you have an adjustable-rate mortgage (ARM) , your rate is tied to financial indexes and can change after a set period (e.g., 5/1 ARM means fixed for 5 years, then adjusts annually).

- ✅ Example : If you had a 3% rate on a 5/1 ARM and the rate reset to 6%, your monthly payment could jump significantly.

- 📉 What to do : Consider refinancing into a fixed-rate mortgage if rates are still manageable.

2. Property Taxes Increased

Local governments reassess home values annually or every few years. If your home’s value went up, your property tax bill likely increased too — which gets passed on through your mortgage.

- 💡 Tip : Contact your local assessor’s office to see if you qualify for a homestead exemption or appeal the valuation if needed.

3. Homeowners Insurance Went Up

Insurance premiums can rise due to:

- Inflation

- Claims history

- Changes in coverage

- Increased risk in your area (e.g., flood zones, wildfire areas)

Since your lender requires proof of insurance, any increase will be reflected in your monthly payment.

4. Removal of Private Mortgage Insurance (PMI)

Wait — removal of PMI should lower your payment, right?

Yes! But confusion can happen if:

- You thought your payment would drop automatically once you hit 20% equity.

- Your payment didn’t decrease because something else (like taxes or insurance) went up at the same time.

📌 Action step : Check with your lender to confirm if and when PMI was removed.

5. Escrow Shortage or Rebalancing

Mortgage lenders collect extra money each month to cover future tax and insurance bills. If those costs rise more than expected, your lender may adjust your payment mid-year.

- This is called an escrow shortage or rebalancing .

- It often results in a temporary increase until the account is balanced again.

6. Missed or Late Payments

If you’ve missed payments or paid late, your lender may add fees or penalties — temporarily increasing your required monthly payment.

Final Thoughts

There are many reasons why your house mortgage went up , but most are tied to property taxes, insurance, loan type, or escrow adjustments . While some increases are beyond your control, staying informed helps you manage your budget and plan ahead.

If you’re unsure what caused the change, contact your lender or servicer for a detailed breakdown of your new payment amount.

Frequently Asked Questions (FAQs)

Q1: Why did my mortgage payment go up by $200?

Your payment likely increased due to higher property taxes, insurance premiums, or an escrow shortage.

Q2: Can my mortgage company raise my payment without notice?

They must notify you of changes — especially if there’s a significant increase in your escrow payments.

Q3: Does a mortgage payment always go up over time?

Not necessarily. Fixed-rate mortgages keep principal and interest the same, but taxes, insurance, and other fees can cause overall payments to rise.

Join The Discussion