Zillow is best known for home listings, but it’s also a powerful tool for homebuyers looking to explore mortgage options and compare home loan rates. The Zillow Home Loan service connects buyers with top lenders, helping them find the right financing based on their financial profile and homeownership goals.

Here’s how you can use Zillow to research and apply for a home loan, whether you’re buying your first home or refinancing.

1. What Is Zillow Home Loan?

The Zillow Home Loan feature is not a direct lending service but a mortgage comparison platform that partners with top U.S. lenders to help users:

- Compare current mortgage rates

- Get pre-approved offers

- Explore different loan types (FHA, VA, conventional, jumbo)

- Find customized loan options based on your credit score and down payment

This service is completely free to use and available to all Zillow visitors.

2. How to Use Zillow for Home Loans

Step-by-Step Guide:

- Visit the Zillow Mortgage Page

Go to Zillow Home Loans to start exploring lenders and rates. - Enter Your ZIP Code

This helps Zillow tailor loan offers and local market data to your area. - Choose Your Loan Type

Select from:

- 30-Year Fixed

- 15-Year Fixed

- FHA Loan

- VA Loan

- Jumbo Loan

- Input Your Credit Score Range

Zillow adjusts lender offers based on low, medium, or high credit scores. - View Lender Offers

See real-time interest rates, APRs, and estimated monthly payments from multiple lenders. - Apply or Get Pre-Approved

Some lenders allow you to begin the application or pre-approval process directly through Zillow.

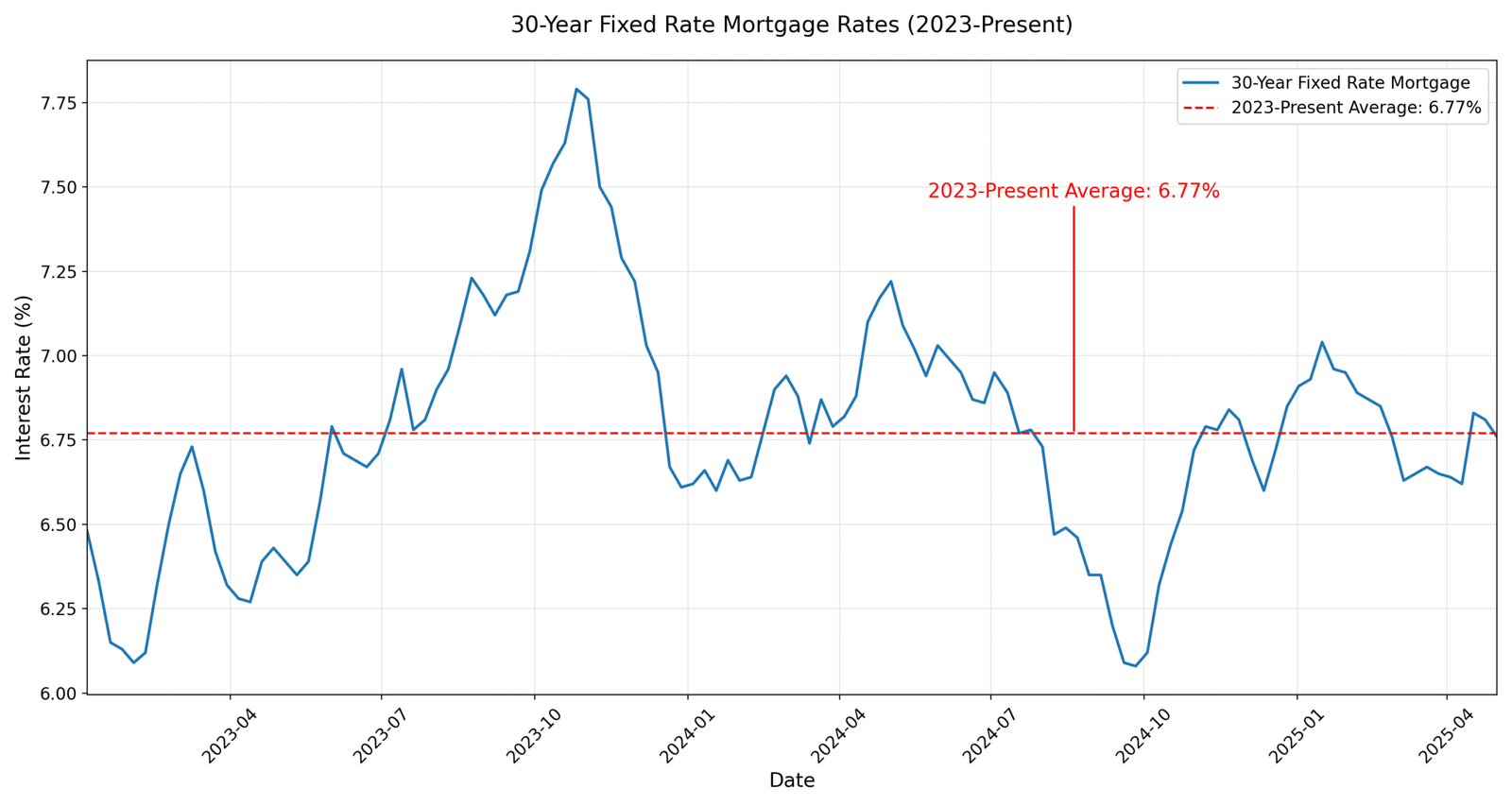

3. Current Average Mortgage Rates on Zillow (Early 2025)

| Loan Type | Average Rate (APR) |

|---|---|

| 30-Year Fixed | ~6.2% |

| 15-Year Fixed | ~5.5% |

| FHA Loan (30-Year) | ~6.0% |

| VA Loan (30-Year) | ~5.9% |

| Jumbo Loan (30-Year) | ~6.1% |

Note: Rates vary by lender, credit profile, and market.

4. Benefits of Using Zillow for a Home Loan

- Free to Use: No cost to compare rates or contact lenders

- Multiple Lenders: View offers from national banks, credit unions, and online lenders

- Personalized Results: Tailor results to your credit score and down payment

- Educational Tools: Includes calculators, articles, and tips for first-time buyers

- Mobile-Friendly: Access loan options on the go via the Zillow app

5. Tips for Getting the Best Home Loan Through Zillow

- Check Multiple Lenders: Don’t settle for the first offer

- Improve Your Credit Score: Even small increases can lower your rate

- Consider Paying Points: Buy down your rate if you plan to stay long-term

- Lock in Your Rate once you’re satisfied with the offer

- Compare Total Costs, not just the interest rate (look at APR and fees)

Conclusion

Using Zillow Home Loan tools gives buyers and refinancers access to competitive mortgage offers from trusted lenders—all in one place. Whether you’re looking for a low-rate VA loan, a flexible FHA option, or a conventional mortgage, Zillow makes it easy to compare and connect with the right lender for your needs.

Frequently Asked Questions (FAQ)

Q: Does Zillow offer home loans directly?

A: No, Zillow partners with third-party lenders to provide mortgage products and rate comparisons.

Q: Are Zillow mortgage rates updated daily?

A: Yes, Zillow updates its mortgage rate data daily to reflect current market conditions.

Q: Can I get pre-approved through Zillow?

A: Yes, some lenders on Zillow allow you to start the pre-approval process online after entering your financial details.

Join The Discussion