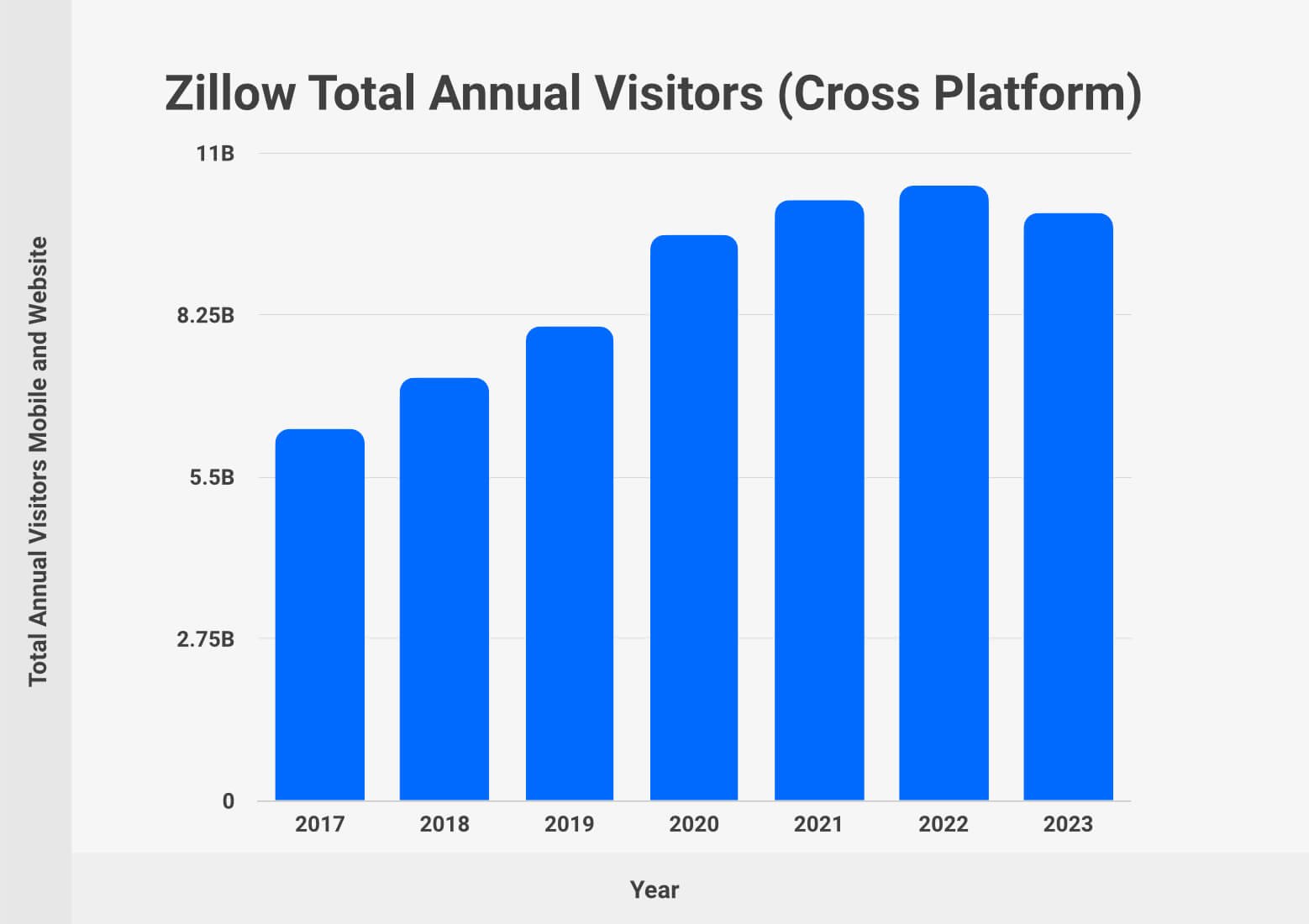

Zillow Group, Inc. (NASDAQ: ZG) is a leading online real estate marketplace that has transformed how people buy, sell, and rent homes in the United States. As of 2025, investors continue to watch Zillow stock closely due to its evolving business model, market position, and growth potential.

Here’s a detailed look at Zillow’s stock performance, financials, business segments, and whether it’s a good investment today.

1. Company Overview: What Does Zillow Do?

Zillow operates several brands under its umbrella, including:

- Zillow.com: The flagship real estate listing platform

- Zillow Offers: iBuying and home-flipping arm (re-launched after a pause)

- Mortech and LendingTree Acquisition: Expanded into mortgage services and fintech

- Rentals and New Construction: Offering tools for renters and developers

Zillow generates revenue from advertising, subscription services, and real estate transactions.

2. Zillow Stock Performance (2025 Snapshot)

| Metric | Value |

|---|---|

| Current Stock Price (ZG) | ~$60–$70/share (as of early 2025) |

| Market Cap | ~$9 billion |

| P/E Ratio | N/A (still operating at a loss or limited profit) |

| 52-Week High/Low | $85 / $45 |

| Dividend Yield | 0% (no dividend) |

Note: Prices are approximate and subject to change based on market conditions.

Zillow’s stock has experienced volatility over recent years due to shifting strategies in its iBuying segment and broader real estate market trends.

3. Key Business Segments Driving Growth

a. Internet, Media & Technology (IMT)

- Core advertising business for agents, brokers, and lenders

- High-margin and stable source of revenue

b. Premier Agent Program

- One of Zillow’s most profitable offerings

- Real estate professionals pay for leads and visibility

c. Homes (iBuying & Resale)

- Zillow re-entered the home-buying market with a more cautious strategy

- Focuses on selective markets and lower-risk inventory

d. Mortgages & Other Services

- Leverages the LendingTree acquisition to offer mortgage solutions

- Expands Zillow’s role across the entire homebuying journey

4. Recent Developments Affecting Zillow Stock

- Re-entry into iBuying with tighter controls

- Expansion of mortgage and title services

- AI-driven home valuations and search improvements

- Partnerships with local real estate firms

- Regulatory changes impacting real estate tech

These moves suggest a strategic pivot toward sustainable growth rather than aggressive expansion.

Conclusion

Zillow remains a dominant player in the U.S. real estate tech space. While Zillow stock has faced challenges, particularly around profitability and housing market fluctuations, its evolving business model and expansion into mortgages and fintech make it an intriguing long-term play for investors who believe in the digitization of real estate.

As always, investors should consider their risk tolerance and do further due diligence before investing.

Frequently Asked Questions (FAQ)

Q: Is Zillow a good stock to buy in 2025?

A: It depends on your outlook for the real estate market and Zillow’s ability to execute its new strategy. It can be a speculative but potentially rewarding investment.

Q: Does Zillow pay dividends?

A: No, Zillow does not currently pay any dividends and is reinvesting profits into growth initiatives.

Q: What is affecting Zillow’s stock price?

A: Key factors include housing market trends, mortgage rate changes, competition, and Zillow’s success in turning its Homes division profitable.

Join The Discussion